Stocks Tumble To Red For 2014, Biotech Hammering Continues

For the first time in over 6 weeks, all major US equity indices are in the red for 2014. Early-year leaders Nasdaq and Russell are being crushed by the battering …

Read More

For the first time in over 6 weeks, all major US equity indices are in the red for 2014. Early-year leaders Nasdaq and Russell are being crushed by the battering …

Read More

The Nasdaq 100 is at a similar bounce point to early February. That is as far as this post will go. You tell me if it will follow a similar …

Read More

The Third Estimate for Q4 GDP, to one decimal, came in at 2.6 percent, up from 2.4 percent in the Second Estimate. The GDP deflator used to calculate real (inflation-adjusted) …

Read More

Opening Market Commentary For 03-27-2014 Premarkets were down ~0.12% on the average and made a dip when the it was reported the US Economy grew at an annual rate of …

Read More

That any schoolkid could predict eliminating feedback and consequences will lead to a series of disastrously poor choices by speculators and imprudent borrowers doesn’t register with the Keynesian Cargo Cult. …

Read More

The market looks like it wants to bounce, based on ‘pre’. But with the bearish engulfing candles several indexes painted yesterday and with the TLT-SPY risk ON/OFF indicator in its …

Read More

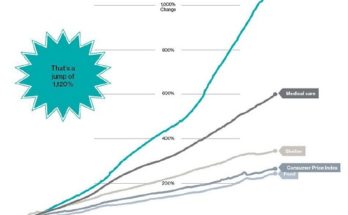

In the midst of your morning routine, you can probably lay out a number of situations in which you reach into your pocket to pay people or vendors for services/products …

Read More

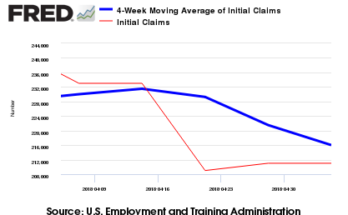

Blue Line 4 Week Average The market was expecting the weekly initial unemployment claims at 295,000 to 335,000 (consensus 323,000) vs the 311,000Â reported. The more important (because of the volatility …

Read More

And so the various estimates of Q4 GDP have made an almost full circle: starting at 3.22% in the first forecast, plunging to 2.38% in the second, and finally settling …

Read More

These are not happy charts: The Nasdaq and Russell have gone from Spitting to Vomiting Cobra patterns, with 10% drops certainly looking like they are in the cards as things …

Read More