Central Banks Have Violated Fundamental Laws Of Finance

Is Monetary Policy Too Complicated for Mainstream to Understand? It is amazing how far Central Banks have been allowed to go with regard to policy tools and influence, and how …

Read More

Is Monetary Policy Too Complicated for Mainstream to Understand? It is amazing how far Central Banks have been allowed to go with regard to policy tools and influence, and how …

Read More

Deflationary fear and a slowdown have started to trouble developed international markets, and most investors in the ETF world are looking out for quality exposure in the area. In fact, …

Read More

The story of the unfolding Q4 earnings season is essentially a commentary on three inter-related factors — oil, the U.S. dollar and global economic growth. Oil aside, the other two …

Read More

As another new month approaches I am reminded, once again, to look at my portfolio holdings and decide where to deploy my fresh capital for the month. Looking back at …

Read More

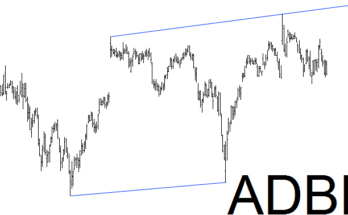

It’s been said that there is an inverse correlation between the confidence a trader has and the outcome of whatever they are predicting. If that’s true, I should be awfully worried, because I am …

Read More

FXCM (FXCM) Inc., the largest retail foreign-exchange brokerage in the U.S., has adopted a shareholder rights plan with a 10% trigger, with the goal of preventing potential hostile takeover attempts of the …

Read More

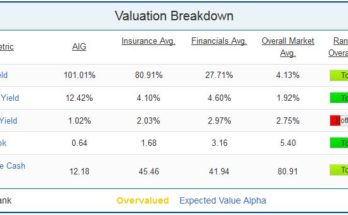

A) Introduction American International Group (NYSE:AIG) has to be one of the most unloved stocks in the entire market. While the company was widely criticized for its role in causing …

Read More

DOW – 251 = 17,164 SPX – 26 = 1994 NAS – 48 = 4635 10 YR YLD – .08 = 1.67% OIL + 3.25 = 47.78 GOLD + 25.00 …

Read More

REITs have been a hot sector in a volatile stock market. With share prices soaring in January, upcoming yields on these three stocks will be driven down greatly impacting every …

Read More

“Amazingly, people are paying Switzerland to warehouse their money for 10 years…That makes gold a high-yielder, because it yields zero†– Jeff Gundlach Jeff Gundlach is correct. At 0%, Gold is …

Read More