Care Capital Properties (CCP) is a relatively new dividend-payer. It was spun off from healthcare REIT giant Ventas (VTR) in 2015.

Since Care Capital has only been trading independently for a little over a year, it has not yet established a long dividend track record.

But it has potential: Care Capital has a high-quality portfolio and should benefit from a structural advantage going forward, which is the aging U.S. population.

As a result, it’s possible Care Capital could eventually become a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

Care Capital stock has a current dividend yield of 9% – this is more than four times the average dividend yield in the S&P 500 Index.

The company is committed to maintaining and growing the dividend over time, and has taken several promising steps to secure its hefty payout.

Business Overview

Care Capital is a real estate investment trust, or REIT. It operates in the healthcare industry, with a focus on skilled nursing facilities.

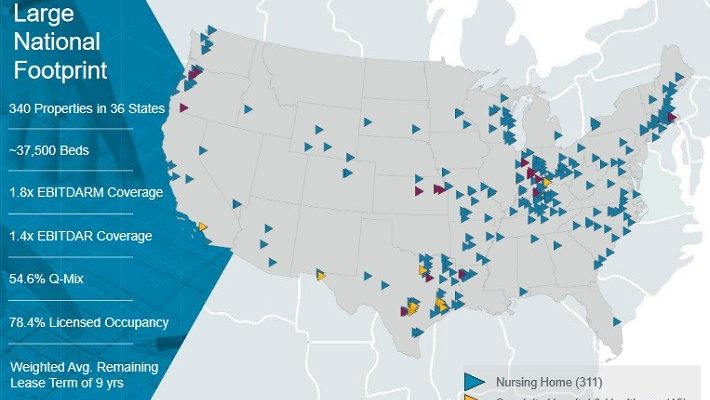

Care Capital has an extensive portfolio that stretches across the U.S. It operates 311 nursing homes, 15 specialty hospitals, and another 14 senior housing facilities.

(Click on image to enlarge)

Source:Â November 2016 Investor Presentation, page 17

Over the first nine months of 2016, funds from operation, or FFO, declined 12% to $2.18 per share. This was primarily due to higher interest expense.

In the first nine months of the year, interest expense increased to $35 million from $4 million in the same period of 2015.

Higher expenses are likely to suppress FFO for the full year. For 2016, the company expects FFO in a range of $2.85-$2.89 per share. At the midpoint, this would represent a 13% decline from 2015.

After a strong performance in 2015, in which FFO increased 7.8% from 2014, Care Capital is likely to take a step backward in 2016.

If interest rates continue to rise in 2017 and beyond, it will be a continued headwind for Care Capital. REITs rely on debt financing to acquire new properties.