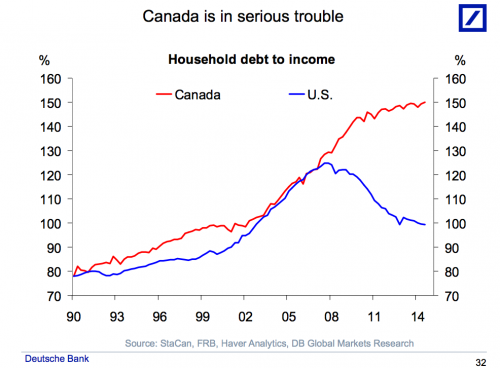

Some time ago, Deutsche Bank’s chief international economist, Torsten Slok, presented several charts which showed that  “Canada is in serious trouble” mostly as a result of its overreliance on its frothy, bubbly housing sector, but also due to the fact that unlike the US, the average Canadian household had failed to reduce its debt load.

Â

Additionally, the German economist demonstrated that it was not just the mortgage-linked dangers from the housing market (and this was before Vancouver and Toronto got slammed with billions in “hot” Chinese capital inflows) as credit card loans and personal lines of credit had both surged, even as multifamily construction was at already record highs and surging, while the labor market had become particularly reliant on the assumption that the housing sector would keep growing indefinitely, suggesting that if and when the housing market took a turn for the worse, or even slowed down as expected, a major source of employment in recent years would shrink.

Â

Fast forward to last summer, when the trends shown by Slok three years ago had only grown more acute, with Canada’s household debt continuing to rise, its divergence with the US never been greater…

Â