Saying that income investors like high yields is like saying hungry kids (and certain investment writers) like cookies – it’s an understatement.

So it’s no surprise that New Residential Investment Corp. (NYSE: NRZ) is one of the most requested stocks in the Safety Net column.

This mortgage real estate investment trust (REIT) yields 11.1% and has raised the dividend every year since it began paying one in 2013.

But sky-high yields tend to come with more risk.

Is there risk to this dividend? Let’s find out.

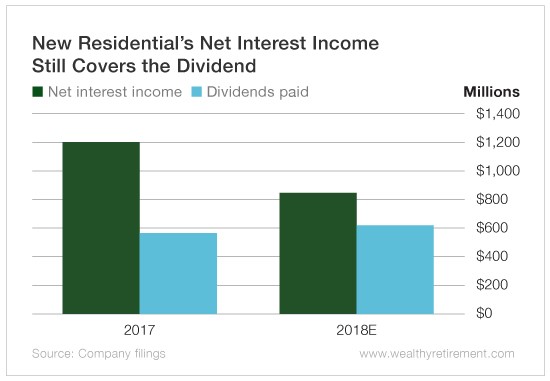

I last covered New Residential Investment Corp. in November. At the time, the stock was graded B for dividend safety. The only mark on its record was an expected $82 million drop in net interest income (NII) in 2018.

Mortgage REITs borrow money short term and lend it long term. The money they make (after expenses) on the spread between the two interest rates is NII.

New Residential’s NII picture has deteriorated since November.

When I wrote the article last year, its NII was forecast to come in at $1.06 billion and dip to $978 million this year.

Six months later, New Residential’s 2018 NII is now forecast to be $856 million. That’s likely due to the flattening of the yield curve.

Remember, the company makes money based on the difference between short- and long-term yields. Currently, that spread between the yields is contracting. If the spread expands, New Residential will make more money. However, if the spread shrinks even more, so will New Residential’s NII.

We don’t want to see that kind of decline in NII, especially for a company that pays a big dividend.

Fortunately, the lower projected NII still comfortably covers the expected dividend this year…

If Wall Street estimates are correct, the company will pay out 72% of its NII in the form of dividends this year. That’s up significantly from last year’s 46% but is still within my comfort zone.