After emerging from the brutal financial crisis of 2008, the banking and financial services industries are finally generating some solid growth. As Americans start to get comfortable with the stock market again, investment flows are starting to return to U.S. equities from the retail investor community. Many of these investors are turning to the services provided by independent brokerage and advisory firms in an effort to optimize their portfolios and meet their investment goals. In addition, the equity underwriting space is seeing some of the best activity in years.

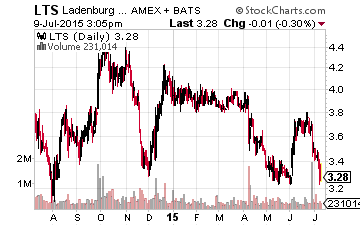

Ladenburg Thalmann Financial Services, Inc. (NYSE: LTS)Â is a diversified company whose platform includes broker-dealers, asset management, investment banking, life insurance products, and equity research. The firm posted record high revenue and net income in 2014, and there is good reason to believe that this trend will continue into the future.

Ladenburg now offers a network of 4,000 financial advisors and has $125 billion in client assets under management (AUM) thanks to organic growth and some key recent acquisitions. I am intrigued by the firm’s robust range of services, upward trending growth, and notable insider buying. The company has a market capitalization of just over $600 million and surprisingly has little analyst coverage at the moment despite the company having been a member of the New York Stock Exchange for 135 years.

Offering a Diversified Range of Financial Services:

The two primary arms of Ladenburg Thalmann are its independent brokerage and advisory services (IBD) sector, and investment banking and capital markets division. The firm’s IBD business maintains five broker- dealer and registered investment advisor firms as standalone operations. LTS preserves the independence of those businesses in an effort to maintain their history and culture while enabling them to leverage the technological and back office support of the overarching company.

Ladenburg’s advisors have access to all the resources of the company, from its capital market products and investment banking services to its proprietary institutional equity research. So far the strategy seems to be working, as recurring revenues in its IBD operations improved to a solid 71% in 2014.