With a possible end (more or less) to the Greek debt crisis taking shape last week, investors were once again confident enough to get back to their buying ways. When it was all said and done, the market gained about 2.4%, crawling back above some key resistance levels in the process.Â

And yet, stocks didn’t quite clear their biggest hurdles, and in rare cases where the indices managed to make good technical progress, they ran into other walls. In other words, there are still several ways from here the bears could capitalize on the market’s weak points.

We’ll take a look at all the market’s pros and cons in a moment, after a quick review of last week and this week’s key economic numbers.

Economic Data

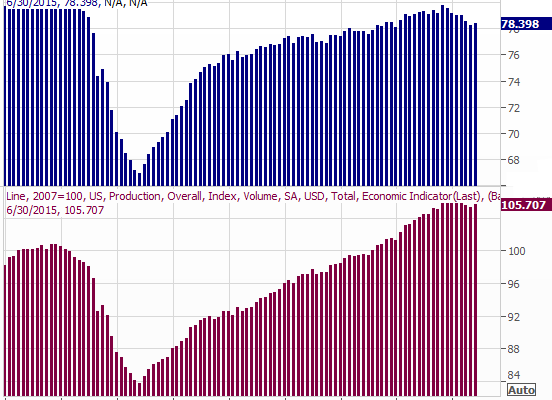

It was plenty busy last week in terms of economic news, but two sets of data came to the forefront. On Wednesday we got June’s capacity utilization and industrial productivity figures. After some softness in the first and second quarters of the year, each appears to be pointed higher again. That said, one good month – or even two good months – doesn’t make or break a trend.

Industrial Production and Capacity Utilization Chart

Source: Thomas Reuters

Then on Friday we learned June’s levels of housing starts and building permits. They were, in a word, impressive, at or near multi-year highs in both cases. Neither hit those big levels out of the blue, however. They’ve each been trending higher for a couple of years now, suggesting the growth is healthy and sustainable.

Housing Starts and Building Permits Chart

Source: Thomas Reuters

Everything else is on the following grid:

Economic Calendar

Source: Briefing.com

We’ll continue to flesh out the current state of the real estate market this week, with June’s existing-home sales tally on Wednesday, and the new-home sales pace on Friday. Both have been trending higher for some time (albeit a choppy trend), and are expected to extend those uptrends through last month.Â