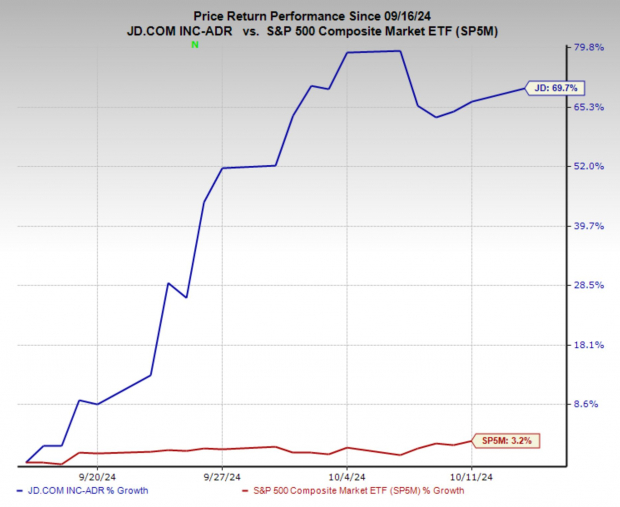

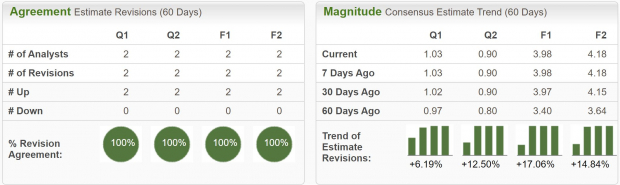

JD.com () has benefitted from the strong breakout of Chinese equities in recent weeks as the Chinese authorities have unveiled a major economic stimulus package. JD stock has rocketed higher over the last few weeks and appears to be forming a technical bullish pattern indicating another major bull run may be approaching.JD.com also boasts a Zacks Rank #1 (Strong Buy) rating, strong earnings growth forecasts and a discounted valuation, making the stock extremely appealing at current levels.JD.com, also known as Jingdong, is one of China’s largest e-commerce companies, specializing in online retail. Founded in 1998 and headquartered in Beijing, it started as a brick-and-mortar store selling electronics but later transitioned to an online platform. JD.com is known for its vast logistics network, which includes warehousing and delivery capabilities, ensuring fast and reliable service across China.The company offers a wide range of products, including electronics, apparel, and household goods, catering to millions of consumers. JD.com distinguishes itself from competitors like Alibaba by focusing on direct sales and its own inventory, which helps maintain quality control. The company is also heavily involved in technological development, such as artificial intelligence and automation, to improve its logistics and retail services.(Click on image to enlarge) Image Source: Zacks Investment Research JD Boasts Upward Trending Earnings RevisionsAs noted, JD.com enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions. Analysts have unanimously upgraded earnings estimates across timeframes, with FY24 estimates increasing by 17.1% and FY25 estimates climbing by 14.8%.Earnings are forecast to grow at 17.6% annually over the next three to five years and the company has been buying back shares aggressively, with plans to repurchase $5 billion worth over the next 36 months.

Image Source: Zacks Investment Research JD Boasts Upward Trending Earnings RevisionsAs noted, JD.com enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions. Analysts have unanimously upgraded earnings estimates across timeframes, with FY24 estimates increasing by 17.1% and FY25 estimates climbing by 14.8%.Earnings are forecast to grow at 17.6% annually over the next three to five years and the company has been buying back shares aggressively, with plans to repurchase $5 billion worth over the next 36 months. Image Source: Zacks Investment Research Bullish Technical Setup in JD StockThe technical pattern on JD stock is especially compelling. After breaking out from the massive base several weeks ago, the price has taken a brief rest and built out a bull flag. If the price can trade meaningfully above the $46 level, I would expect another big rally to occur. Alternatively, if it loses the $42 level of support, it may need more time, and investors may want to wait for another opportunity.

Image Source: Zacks Investment Research Bullish Technical Setup in JD StockThe technical pattern on JD stock is especially compelling. After breaking out from the massive base several weeks ago, the price has taken a brief rest and built out a bull flag. If the price can trade meaningfully above the $46 level, I would expect another big rally to occur. Alternatively, if it loses the $42 level of support, it may need more time, and investors may want to wait for another opportunity.

Image Source: TradingView JD Shares Trade at a Fair ValuationBecause the Chinese stock market has been under selling pressure for nearly three years following a collapse in the real estate market and broad economic slowdown, JD along with other leading stocks in the country are trading a deeply discounted valuations.Today, JD.com is trading at a one year forward earnings multiple of 11.7x, which is well below the market average and its five-year median of 42.8x. And with earnings forecast to grow 17.6% annually over the next several years, JD has a PEG ratio of just 0.66, a discount based on the metric.Finally, JD pays a tidy 1.7% dividend yield, which has been raised by 23% in the last year.

Image Source: Zacks Investment Research Should Investors Buy Shares in JD.comJD.com presents a compelling investment opportunity given its current fundamentals and favorable market conditions. The mix of strong profit growth, cheap valuation and strong stock price momentum makes for a trifecta of bullish catalysts.It should be noted that investing in international stocks comes with an additional level of risk, but for investors looking to allocate internationally or to trade momentum stocks, JD.com may be a great stock to buy.More By This Author:4 Permian-Focused Energy Stocks To Put In Your WatchlistShould Investors Buy Delta Air Lines Stock After Mixed Q3 Results?Bear Of The Day: Altice USA

Bull Of The Day: JD.com