DAVE INC () is a rising player in the FinTech and mobile banking space, making a name for itself by catering to underserved banking customers. Seed investor and Mark Cuban praised the company for excluding overdraft fees, recalling how they crushed him in his twenties.The standout feature of DAVE INC’s platform is its cash advance service, which provides short-term payday loans without interest, origination fees, or other traditional charges. Instead, the company generates revenue through expedited service fees, a monthly subscription, and an optional tipping model, giving users a flexible and transparent alternative to traditional financial services.DAVE stock has been on an incredible tear this year, up more than 10x since the start of 2024. However, it appears that even after such strong price appreciation, there may still be plenty of upside and limited downside. The company is growing extremely fast, has a very reasonable valuation and currently boasts a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions.

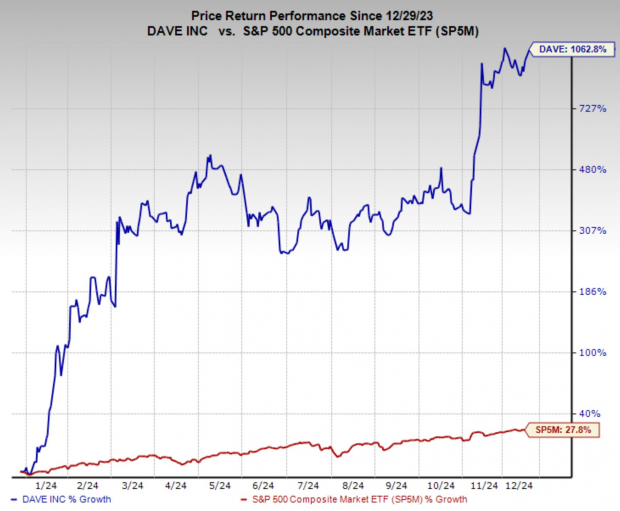

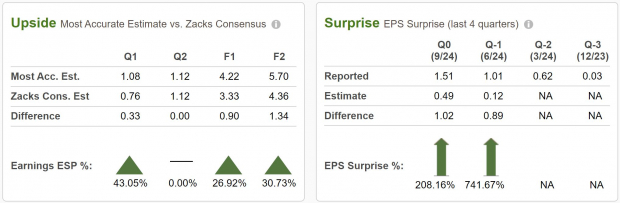

Image Source: Zacks Investment Research DAVE is Crushing Earnings EstimatesPart of the reason why DAVE INC stock is up so much this year is that it has been absolutely blowing analysts’ earnings estimates out of the water. During the last two quarterly earnings reports DAVE beat earnings estimates by 208% and 742% respectively. Furthermore, the Zacks Earnings ESP is forecasting further upside earnings surprises, with next quarter projected to beat expectations by 43%.This isn’t to say that analysts are sandbagging their earnings estimates, because they continue to raise forecasts. Current quarter earnings estimates have risen by 46% in the last 60 days, while FY24 estimates have climbed by 26.6% over the same period. Over the next year earnings are expected to grow more than 30% YoY and sales projected for 31.6% growth.Because of this tremendous increase in company profits and even with the huge price appreciation, DAVE INC is still trading at a fair valuation, and possibly even a discount based on its growth projections. Today, DAVE is trading at just 22.5x next year’s earnings.(Click on image to enlarge) Image Source: Zacks Investment Research DAVE Stock Primed to Breakout AgainAlthough it may be hard to imagine a stock up so much YTD could continue to rally, the developments in DAVE’s profit and sales growth demonstrate just how undervalued the stock was at the beginning of the year. It is also worth noting that the stock price is still considerably below its all-time high of $490, which it made back in 2022.DAVE stock has again been coiling over the last month, and on Monday showed considerable buying pressure. If DAVE shares can hold above the $100 level, it is only a matter of time before the stock goes on another big run.While growth and momentum stocks can experience massive rallies, they are also prone to equally sharp corrections due to their typically high valuations. However, given the reasonable forward earnings multiple we highlighted, the risk of a significant pullback appears much lower.(Click on image to enlarge)

Image Source: Zacks Investment Research DAVE Stock Primed to Breakout AgainAlthough it may be hard to imagine a stock up so much YTD could continue to rally, the developments in DAVE’s profit and sales growth demonstrate just how undervalued the stock was at the beginning of the year. It is also worth noting that the stock price is still considerably below its all-time high of $490, which it made back in 2022.DAVE stock has again been coiling over the last month, and on Monday showed considerable buying pressure. If DAVE shares can hold above the $100 level, it is only a matter of time before the stock goes on another big run.While growth and momentum stocks can experience massive rallies, they are also prone to equally sharp corrections due to their typically high valuations. However, given the reasonable forward earnings multiple we highlighted, the risk of a significant pullback appears much lower.(Click on image to enlarge)

Image Source: TradingView Should Investors Buy Shares In DAVE?DAVE Inc. is an exciting and rapidly growing newcomer to the fintech industry. While its stock has experienced significant volatility, the company’s future appears exceptionally promising.Earnings have surged into positive territory in recent months, exceeding expectations and signaling strong growth momentum. Coupled with consistent, substantial earnings and standout stock performance this year, DAVE INC presents a compelling investment opportunity, offering an attractive balance of fair valuation and robust growth potential.More By This Author:3 Food Industry Stocks To Feast On Before The New Year Rings InBroadcom Beats Earnings Estimates As AI Revenue Triples2 Top-Performing Stocks To Watch After Earnings: AI, UNFI

Bull Of The Day: Dave Inc