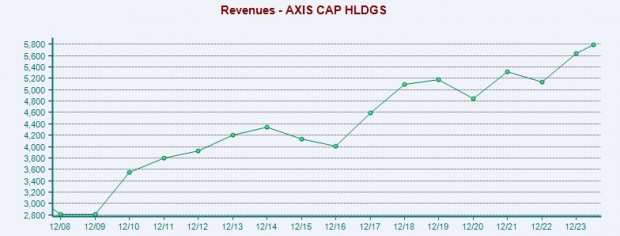

Axis Capital Holdings’ () stock stands out among the Zacks Insurance-Property and Casualty Industry which is currently in the top 8% of over 250 Zacks industries.Providing a broad range of specialty insurance and reinsurance services, Axis Capital has a global reach through its operating subsidiaries that extend to markets in the US, Bermuda, Europe, Singapore, Canada, Latin America, and the Middle East.Added to the Zacks Rank #1 (Strong Buy) list this week, AXS lands the Bull of the Day and checks an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum. AXS Performance OverviewDemand for insurance-related services has remained resilient despite broader inflationary concerns. Because of the essentiality of insurance, conglomerates such as Axis Capital have continued to expand and can also reward shareholders with generous dividends.To that point, when including dividends, AXS has a total return of +90% over the last three years which has impressively topped the broader indexes and its industry’s return of +50%.Year to date, AXS has soared over +40% to top the Zacks Insurance-Property and Casualty Market’s +28%. This has also topped the +20% gains of the S&P 500 and Nasdaq this year.(Click on image to enlarge) Image Source: Zacks Investment Research Attractive Growth TrajectoryHaving a steady revenue stream, Axis Capital’s total sales are now expected to be up 7% in fiscal 2024 and are projected to rise another 10% in FY25 to $6.73 billion. Furthermore, FY25 sales projections would represent 30% growth since the pandemic with 2019 sales at $5.17 billion.(Click on image to enlarge)

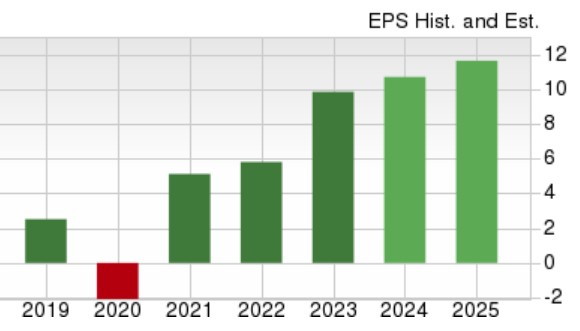

Image Source: Zacks Investment Research Attractive Growth TrajectoryHaving a steady revenue stream, Axis Capital’s total sales are now expected to be up 7% in fiscal 2024 and are projected to rise another 10% in FY25 to $6.73 billion. Furthermore, FY25 sales projections would represent 30% growth since the pandemic with 2019 sales at $5.17 billion.(Click on image to enlarge) Image Source: Zacks Investment ResearchOn the bottom line, Axis Capital is expecting 8% EPS growth in FY24 and FY25. More astonishing, is that FY25 EPS projections of $11.64 would be a 362% increase from pre-pandemic earnings of $2.52 per share in 2019.(Click on image to enlarge)

Image Source: Zacks Investment ResearchOn the bottom line, Axis Capital is expecting 8% EPS growth in FY24 and FY25. More astonishing, is that FY25 EPS projections of $11.64 would be a 362% increase from pre-pandemic earnings of $2.52 per share in 2019.(Click on image to enlarge) Image Source: Zacks Investment Research Enticing Valuation & DividendDespite a very impressive YTD rally, AXS still trades at just 7.2X forward earnings which is well below the benchmark S&P 500’s 24.1X.Even better, Axis Capital’s stock is trading at a nice discount to its industry average of 13.6X forward earnings with some noteworthy peers being The Progressive Corporation () and ProAssurance Corporation () .(Click on image to enlarge)

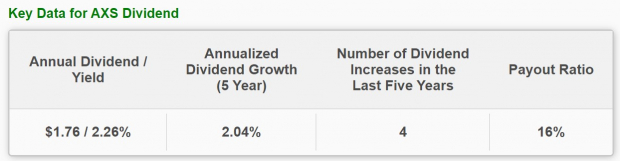

Image Source: Zacks Investment Research Enticing Valuation & DividendDespite a very impressive YTD rally, AXS still trades at just 7.2X forward earnings which is well below the benchmark S&P 500’s 24.1X.Even better, Axis Capital’s stock is trading at a nice discount to its industry average of 13.6X forward earnings with some noteworthy peers being The Progressive Corporation () and ProAssurance Corporation () .(Click on image to enlarge) Image Source: Zacks Investment ResearchAdding more value to AXS is that Axis Capital’s 2.24% annual dividend yield impressively tops the benchmarks’ 1.24% average and its industry average of 0.16%.Axis Capital’s 16% payout ratio and increased probability also indicates there is plenty of room for the insurance giant to raise its dividend in the future.(Click on image to enlarge)

Image Source: Zacks Investment ResearchAdding more value to AXS is that Axis Capital’s 2.24% annual dividend yield impressively tops the benchmarks’ 1.24% average and its industry average of 0.16%.Axis Capital’s 16% payout ratio and increased probability also indicates there is plenty of room for the insurance giant to raise its dividend in the future.(Click on image to enlarge) Image Source: Zacks Investment Research Bottom LineEarnings estimate revisions have remained higher for Axis Capital’s FY24 and FY25, making now an ideal time to buy AXS considering the company’s expansive growth trajectory. This also magnifies Axis Capital’s appealing P/E valuation and alludes to the notion that the strong price performance of AXS should continue. More By This Author:These Top Engineering Stocks Are Industrial Products StandoutsStocks Make Record Highs: 3 Top Buys For The Next Bull RunPost-Fed Rate Cut: Buy, Hold, Or Sell Nvidia Stock?

Image Source: Zacks Investment Research Bottom LineEarnings estimate revisions have remained higher for Axis Capital’s FY24 and FY25, making now an ideal time to buy AXS considering the company’s expansive growth trajectory. This also magnifies Axis Capital’s appealing P/E valuation and alludes to the notion that the strong price performance of AXS should continue. More By This Author:These Top Engineering Stocks Are Industrial Products StandoutsStocks Make Record Highs: 3 Top Buys For The Next Bull RunPost-Fed Rate Cut: Buy, Hold, Or Sell Nvidia Stock?

Bull Of The Day: Axis Capital Holdings