It’s no secret that Warren Buffett is a fan of dividend stocks. The Oracle of Omaha owns many of them, including Bank of New York Mellon (BK).

Approximately 0.7% of Buffett’s $148 billion stock portfolio is comprised of Bank of New York Mellon stock.

Bank of New York Mellon is a diversified financial services company. It serves its clients in 35 countries, and 100 markets.

Now that interest rates are on the rise again, the bank’s growth is picking up.

This is allowing it to return more cash to shareholders. Bank of New York Mellon raised its dividend payout last year, for the first time since 2014.

It still has a long way to go before it becomes a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

That being said, Bank of New York Mellon has a strong balance sheet, competitive advantages, and multiple catalysts for growth.

Bank of New York Mellon could raise its dividend by 10% or more per year moving forward.

This article will discuss why Bank of New York Mellon could be one of the highest dividend growth stocks in the financial sector.

Business Overview

Berkshire Hathaway owns approximately $1 billion worth of Bank of New York Mellon. But why?

The answer most likely has to do with consistency.

To say that Bank of New York Mellon has stood the test of time would be an understatement. It was founded by Alexander Hamilton all the way back in 1784. It is America’s longest-running bank.

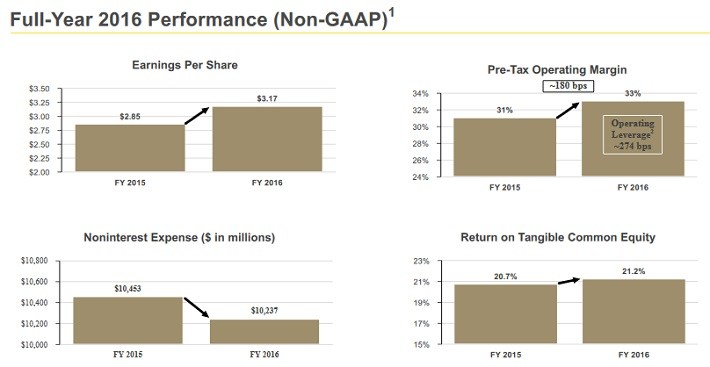

2016 was a successful year for Bank of New York Mellon, on a number of fronts. The company reported adjusted earnings-per-share of $3.17, up 11% from 2015.

Source:Â 4Q Earnings Presentation, page 12

Contributors to this growth included 2% growth in investment service fees, and 4% growth in net interest revenue.

In addition, Bank of New York Mellon realized a 180-basis point expansion of pre-tax operating profit margin last year.