The British Pound outperformed against its G10 FX counterparts at the start of the trading week. The move may reflect pre-positioning ahead of this week’s release of the Bank of England Financial Stability Report and subsequent press conference with Governor Mark Carney.

Traders may be speculating that the policy-setting FPC committee might signal an intent to claw back some of the generous liquidity provision put in place ahead last year’s Brexit referendum. UK credit conditions are their most accommodative in nearly three years, spurring worries about malinvestment.

The Japanese Yen declined as stocks rose in Asian trade, sapping demand for the perennially anti-risk currency. The sentiment-sensitive Australian Dollar advanced, tracking Japan’s Nikkei 225 equities benchmark and S&P 500 futures upward.

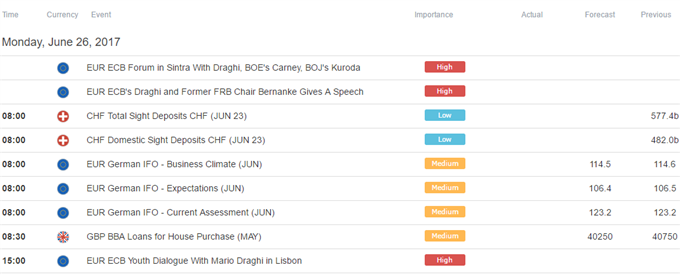

Looking ahead, Germany’s IFO business confidence survey may pass relatively unnoticed by the Euro considering the figures’ limited implications for near-term ECB monetary policy. Flash CPI figures may have a more considerable impact later in the week.

Further on, data is expected to show US durable goods orders fell for a second month straight in May. An outcome echoing recently disappointing news-flow from the world’s largest economy may compound skepticism about further Fed tightening in 2017, hurting the US Dollar.

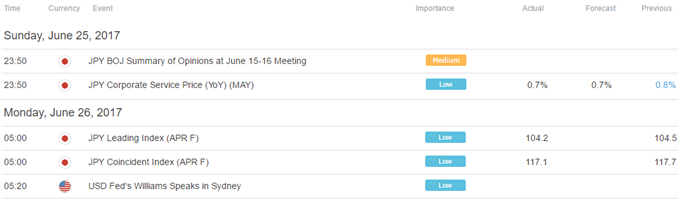

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.