Magnificent 7 Generates Sustainable Earnings Growth

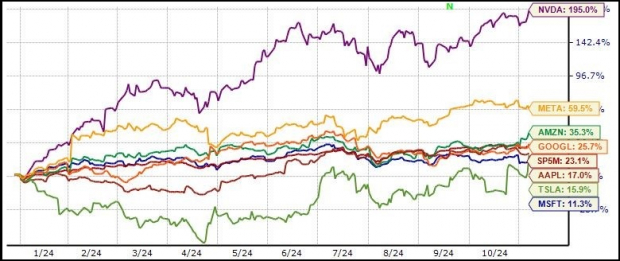

Nvidia ( – ) is the only member of the Magnificent 7 group that has yet to report Q3 results, with the semiconductor leader emerging as a pure play on the artificial intelligence (AI) revolution. Nvidia is expected to report results on November 20th, with the company expected to bring in +81.9% more earnings in Q3 compared to the same period last year on +81.1% higher revenues.Nvidia shares have been stellar performers this year, up over +190% in the year-to-date period and handily outperforming not only its peers in the Mag 7 group but also the broader market and the Tech sector. You can see this in the year-to-date chart below.

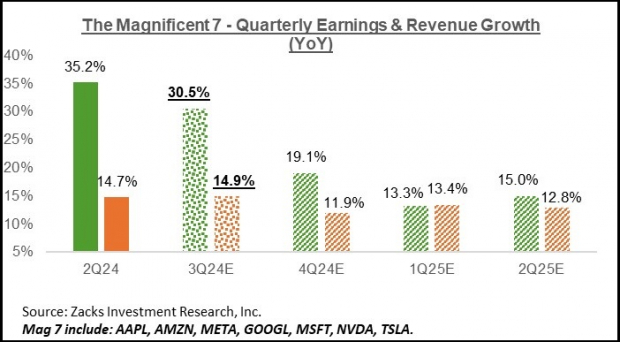

Image Source: Zacks Investment ResearchThe market’s current issues with some of the Mag 7 stocks notwithstanding, there is no escaping the fact that these mega-cap operators are enjoying sustainable profitability growth.These seven companies collectively are on track to bring in $126.2 billion in earnings in Q3 on $492.5 billion in revenues. This represents year-over-year earnings growth of +30.5% on +14.9% higher revenues. Image Source: Zacks Investment ResearchThe Mag 7 companies are on track to account for 23.1% of all S&P 500 earnings in Q3. In fact, had it not been for the Mag 7’s substantial earnings contribution, Q3 earnings for the remaining S&P 500 index would be up only +1.1%. The Earnings Big PictureLooking at Q3 as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total earnings for the S&P 500 index are now expected to be up +6.7% from the same period last year on +5.4% higher revenues.The Q3 earnings growth pace would improve to +9.1% had it not been for the Energy sector drag (decline of -24.2% for Energy). On the other hand, quarterly earnings for the index would be up +1.8% once the Tech sector’s hefty contribution is excluded (earnings growth of +19.4% for the Tech sector).The quarterly earnings growth pace is expected to improve from next quarter onwards. You can see this in the chart below, which shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment ResearchThe Mag 7 companies are on track to account for 23.1% of all S&P 500 earnings in Q3. In fact, had it not been for the Mag 7’s substantial earnings contribution, Q3 earnings for the remaining S&P 500 index would be up only +1.1%. The Earnings Big PictureLooking at Q3 as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total earnings for the S&P 500 index are now expected to be up +6.7% from the same period last year on +5.4% higher revenues.The Q3 earnings growth pace would improve to +9.1% had it not been for the Energy sector drag (decline of -24.2% for Energy). On the other hand, quarterly earnings for the index would be up +1.8% once the Tech sector’s hefty contribution is excluded (earnings growth of +19.4% for the Tech sector).The quarterly earnings growth pace is expected to improve from next quarter onwards. You can see this in the chart below, which shows the overall earnings picture on a quarterly basis.

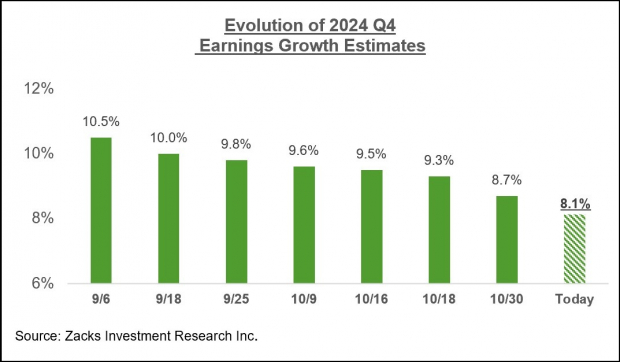

Image Source: Zacks Investment ResearchFor the current period (2024 Q4), total S&P 500 earnings are expected to be up +8.1% on +4.9% higher revenues. Q4 earnings would be up +10.0% had it not been for the Energy sector drag.Estimates for the period have started coming down since the quarter got underway. Still, the pace and magnitude of negative revisions are less than we had seen in the comparable period of Q3. You can see this in the chart below that shows how Q4 estimates have evolved in recent weeks.

Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment ResearchPlease note that this year’s +7.9% earnings growth on only +1.9% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +7.1%, and the revenue growth rate improves to +4.2%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest.More By This Author:Breaking Down Magnificent 7 Earnings ResultsTech Flexes Earnings Power: A Closer LookPreviewing Big Tech Earnings