Four and a half years after Brazil’s FinMin Guido Mantega first re-introduced the world to the term “currency wars,” it appears the Brazilians have admitted defeat. Amid what Goldman calls a sharp decline in consumer confidence – to the lowest level in series history – which could also extend the ongoing macroeconomic adjustment processes and therefore delay the recovery of the economy; Brazil’s central bank has announced that it will no longer intervene to support the Real via its Dollar-Swap program. In a SNB2.0-esque move, though somewhat anticipated by the market, Brazil enables the devaluation that has occurred to perhaps extend (improving competitiveness) and removing what was becoming a notable fiscal drag. Implicitly, Brazil just followed the Swiss and admitted defeat in the global currency war…

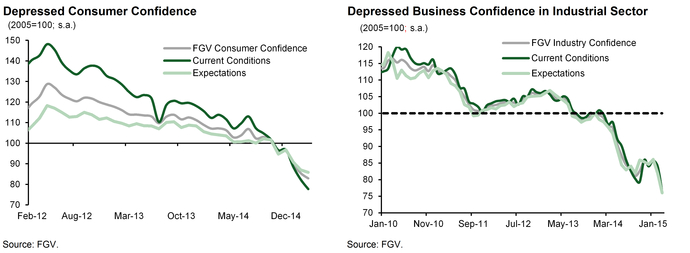

As Goldman notes, according to the monthly FGV Index, consumer confidence (CC) posted a 2.9% mom sa decline in March, adding to the even larger 6.7% and 4.9% mom sa declines recorded in January and February. The overall consumer confidence index is now at its lowest level since the index started to be reported in September 2005. Furthermore, consumer confidence is currently 36% below the April 2012 peak and 28% below the average of the last five years.

The index measuring current conditions declined by a large 5.6% mom sa in March (adding to the 8.6% and 7.0% mom sa declines in Jan and Feb) and the index measuring expectations declined 1.4% mom sa (-6.2% and -4.2% mom sa in Jan and Feb). The two sub-indices are now below the levels sees during the 2008-09 global economic and financial crisis, and also at historical lows (for the series that started in September 2005).

Finally, as reported yesterday, business confidence in the industrial sector declined by a large 8.2% mom sa in March, adding to the 3.4% mom sa decline recorded in February, and is currently 28% below the January 2013 peak. The index measuring current conditions declined 9.0% mom sa in March and the index measuring expectations fell 7.2% mom sa.

Business and consumer confidence remains very depressed given the anticipation of policy tightening, rising inflation, rising taxes, rising interest rates, significant increases in utility and transportation tariffs, deteriorating labor market conditions, and more demanding credit conditions. This poses major headwinds for private consumption and overall activity in the coming months and indirectly contributes to erode overall governability conditions.

Very weak confidence indicators could also extend the ongoing macroeconomic adjustment processes and therefore delay the recovery of the economy.