“The Japan Trade is in trouble,” warns BofA’s Macneil Curry (and rightly so after this week’s utter collapse in Japanese data and Abe’s soaring disapproval rating). Over the course of the past week both USDJPY and the Nikkei have broken key technical levels which point to further substantial downside in the weeks ahead.

BofAML’s Macneil Curry explains…

Specifically, $/Â¥ has closed below its 200d average (now 101.71) for the first time since Nov’12, while the Nikkei has closed below 5wk trendline support (now 15,276). In both cases these breaks of support point to new 2014 lows before greater signs of stabilization. However, we must make clear that, despite our negative medium term outlooks, both of these markets remain in long term bull trends. We will look for these long term bull trends to re-emerge around the beginning of Q4, but for now we are BEARISH.

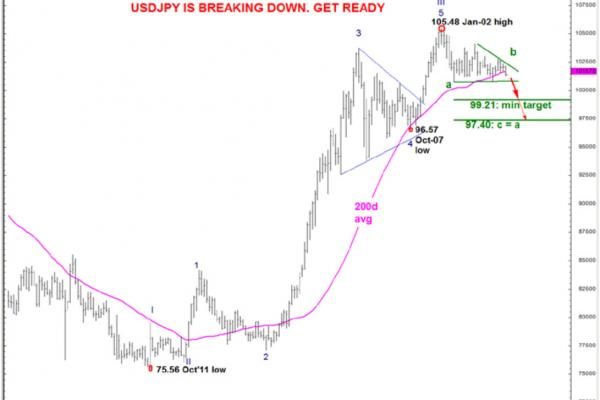

Chart of the week: $/Â¥ is breaking down

Since early Feb, $/Â¥ has been caught in a well-defined contracting range. NOW, the closing break of the 200d (101.71) says that the range trade is giving way for a bear trend. The downside is seen to at least 99.21, potentially 97.40

The Nikkei is rolling over

Similar to $/Â¥, the Nikkei outlook is turning negative. The break of 5wk trendline support (now 15,276) says that further weakness is coming. Minimum downside targets are seen to the multi-month range lows at 13,995, but weakness is more likely to extend to the confluence of support between 13,194/13,107.

*Â *Â *

And if JPY goes, we all know what happens to risk assets around the world (especially now the PBOC has removed the ‘easy’ carry trade in CNY; and Treasury “fails’ threaten to ‘tighten’ repo markets)