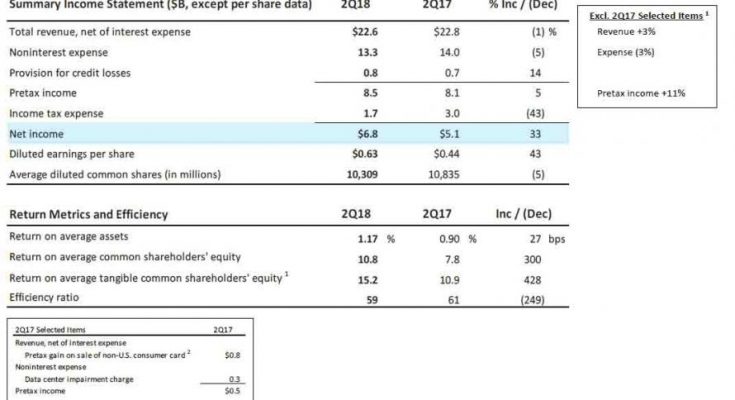

Bank of America joined JPMorgan (if not Wells Fargo) in reporting Q2 earnings that beat on the top and bottom line, reporting Q2 Net Income of $6.8 BN, up 33% from the $5.1BN a year ago, and EPS of $0.63, above consensus exp. of $0.57, and the highest quarterly EPS in the past decade, on revenue of $22.6BN, less than last year’s $22.8BN but better than the $22.1BN expected. According to CFO Paul Donofrio on the earnings call, this was “the best first half in the company’s history” even though the bank just reported its first revenue decline in 2 years.

A big contributor to the jump in the bottom line is the lower tax rate, although pretax income also jumped 11% due to “improved operating performance.”

Â

CEO Moynihan noted the bank’s expense cutting, expenses as well as growth in different areas of the bank:

Solid operating leverage and client activity drove earnings higher this quarter. Responsible growth continued to deliver as a driver for every area of the company. We grew consumer and commercial loans; we grew deposits; we grew assets within our Merrill Edge business; we generated more net new households in Merrill Lynch; and we supported more institutional client activity — all of this while we continued to invest in our businesses and began an additional $500 million technology investment, which we intend to spend over the next several quarters, due to the benefits we received from tax reform.’

As it has done in recent quarters, BofA showed a chart demonstrating its improving operating leverage, which has increased for 14 consecutive quarters, with Q2’s decline in revenue growth offset by a bigger Y/Y drop in operating expenses.

Â

Looking at the balance sheet, BofA reported a very modest, 2% Y/Y increase in loans and leases, which rose to $935BN in Q2 from $932BN in Q1 and up from $915BN a year ago, missing expectations of $943BN and surprising many market observers . The modest increase was the result of an increase in loans in Consumer banking, Wealth Management, Global Banking and Global Markets, offset by a drop in Residential Mortgage and Home Equity loans.