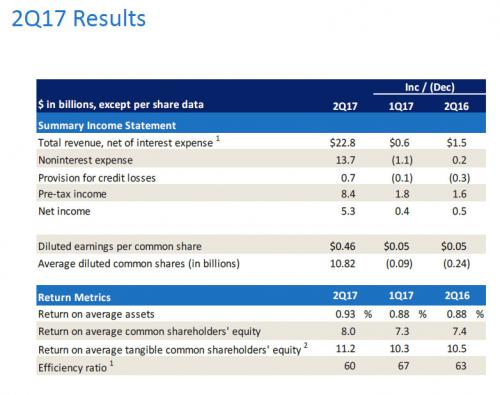

Echoing the trend set by JPM and Wells Fargo last Friday, moments ago Bank of America (BAC) reported revenue and earnings that modestly beat expectations, with Q2 revenue of $22.8bn, above the $21.8bn expected, generating net income of $5.3 billion up 10% Y/Y, and EPS of $0.46, above the $0.43 estimate, and 12% higher than Q2 2016.

Net interest income increased 9%, or $0.9B, to $11.0B while investment banking fees rose 9% to $1.5B. BofA achieved this even though its Net Interest Yield (i.e. NIM) unexpectedly declined from 2.39% in Q1 to 2.34% in Q2 as analysts had expected the number to remain unchanged. As the bank explained, “NII was relatively flat from 1Q17, reflecting the benefits from higher short-end rates and one additional interest accrual day, offset by lower NII in Global Markets… Lower Global Markets NII included the impact of higher funding costs associated with balance sheet growth to support client financing activities in equities.” Looking forward the bank said “Expect 3Q17 NII to increase from 2Q17,  assuming realization of the forward curve and modest growth in loans and deposits.”

BofA also gave the following interest rate sensitivity as of June 30:Â +/- 100bps parallel shift in interest rate yield curve is estimated to benefit NII by $3.2B over the next 12 months, driven primarily by sensitivity to short-end rates

The bank revealed that its provision for credit losses improved to $726 million from $976 million a year earlier, with net charge-offs of $0.9B declining 3% from 1Q17. The bank noted that “consumer net charge-offs at lowest level in over a decade.”

BofA also disclosed a net reserve release of $0.2B in 2Q17, “driven by continued improvements in consumer real estate and energy exposures; net reserve release of $0.1B in 1Q17.” Confirming this point, the amount of Consumer loans 30+ days performing past due declined $0.8B from 1Q17. As of Q2, BofA’s total allowance for loan and lease losses was $10.9B, or 1.2% of total loans and leases. Finally, the bank said that NPLs decreased from 1Q17 across both consumer and commercial with 43% of consumer NPLs current. While overall the loan quality was good, there was an unexpected jump in commercial net charge offs which rose to a 1+ year high of $157MM or 0.14%. Also notable: in the consumer bank, net charge- offs in the U.S. credit-card book climbed 5.6 percent to $640 million, compared to the first three months of the year. Analysts will likely have questions about what the bank sees happening in that book and what it says about the health of the U.S. consumer.