‘Blue chip stocks’ received their name because, in the game of poker, the blue chips have historically had the highest value.

Despite the association with poker, blue chip stocks are for those not looking to gamble on unproven businesses.

In the stock market, blue chip stocks are valued for their low volatility, stable performance profile, and lower relative risk because of their entrenched position in the broader economy.

Unfortunately, there is no formal definition for a blue chip stock. The term is subjective by nature.

At Sure Dividend, we define a ‘blue chip stock’ as a business that:

- Has been operating for 100+ years

- And pays a 3% dividend yield.

Generally speaking, comprehensive lists of blue chip stocks can be a great source of investment opportunities.Â

The Toronto-Dominion Bank (TD) – or TD Bank, for short – is a Canadian financial institution that satisfies our requirements to be a blue chip stock.

And, this stock has been a darling for its investors. TD has delivered market-beating total returns over long periods of time while simultaneously performing very well during the 2007-2009 financial crisis.

This article will analyze the investment prospects of TD Bank in detail.

Business Overview

The Toronto-Dominion Bank is Canada’s largest bank by total assets and second-largest bank by market capitalization.

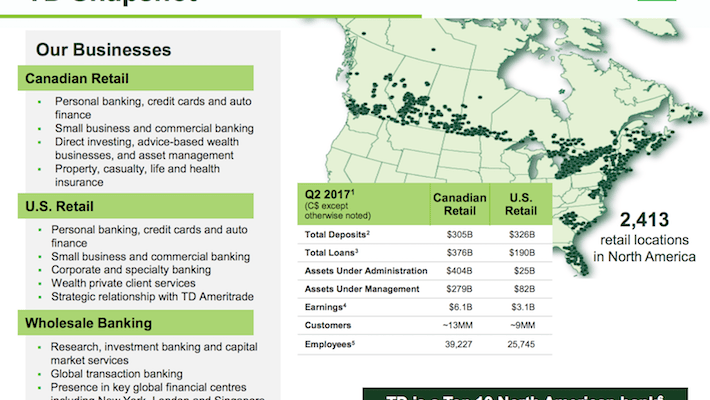

The company reports earnings in three main segments:

- Canadian Retail

- U.S. Retail

- Wholesale Banking

The company also separately reports its share of earnings from TD Ameritrade (AMTD), which it has a significant ownership stake in.

TD Bank has a wide geographic footprint, with 2,413 retail locations across North America at the time of its last quarterly earnings release.

In addition, the company has 39,227 employees in Canada and 25,745 employees in the United States which work together to serve its ~22 million customers.

(Click on image to enlarge)

Source:Â TD Bank Group Second Quarter Earnings Presentation, slide 3

TD’s peer group among the large Canadian financial institutions is comprised of:

- The Royal Bank of Canada (RBC)

- The Bank of Nova Scotia (BNS)

- The Bank of Montreal (BMO)

- The Canadian Imperial Bank of Commerce (CM)