BlackRock’s (BLK - Free Report) reported second-quarter 2018 adjusted earnings of $6.66 per share outpaced the Zacks Consensus Estimate of $6.60. Also, the bottom line came in 28% higher than the year-ago quarter.

Results benefited from an improvement in revenues, rise in assets under management (AUM) and steady long-term inflows. However, an increase in operating expenses acted as a headwind.

Net income (on a GAAP basis) was $1.07 billion, up 26% from the prior-year quarter.

Revenue Growth Offsets Rise in Expenses

Revenues (GAAP basis) were $3.61 billion, increasing 11% year over year. The rise was driven by an increase in all revenue components. The reported figure surpassed the Zacks Consensus Estimate of $3.45 billion.

Total expenses amounted to $2.17 billion, up 8% year over year. This was due to rise in all cost components, except amortization of intangible assets, which witnessed a decline.

Non-operating expenses (on a GAAP basis) were $24 million, against non-operating income of $1 million recorded in the year-ago quarter.

BlackRock’s adjusted operating income was $1.44 billion, up 16% year over year.

Strong AUM & Inflows

As of Jun 30, 2018, AUM totaled $6.30 trillion, reflecting an increase of 11% year over year. Further, during the reported quarter, the company witnessed long-term net inflows of $14.50 billion.

Share Repurchase Update

During the quarter under review, BlackRock repurchased shares worth $300 million.

Our Viewpoint

BlackRock remains well poised for growth, driven by acquisitions and its initiatives to gain market share in the ETF business. However, mounting operating expenses and increased dependence on overseas revenues remain primary near-term concerns.

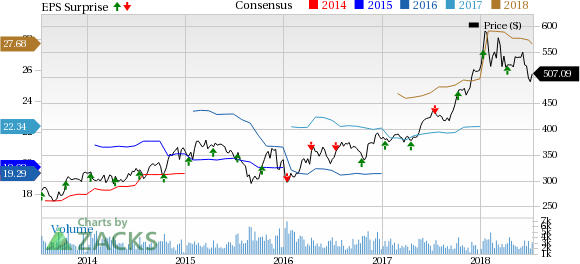

BlackRock, Inc. Price, Consensus and EPS Surprise

BlackRock, Inc. Price, Consensus and EPS Surprise | BlackRock, Inc. Quote

BlackRock currently carries a Zacks Rank #3 (Hold).Â

Earnings Release Dates of Other Investment Managers