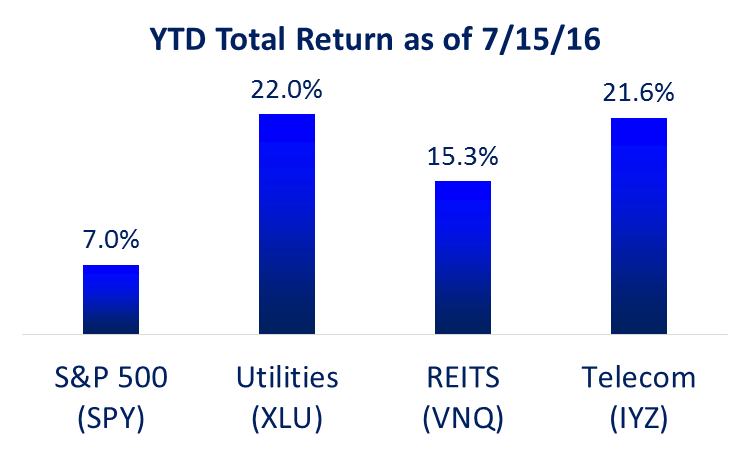

Artificially low interest rates have driven many investors to look to big yield equities to satisfy their income needs. However, as the following chart shows, many of the traditional higher-yield lower-volatility equity categories (such as REITs, utilities and telecom stocks) have recently experienced very strong performance relative to the rest of the market as buyers have bid up their prices.

This strong relative performance doesn’t mean we’re in a bubble, nor does it mean they can’t go even higher, but it does mean investors should use caution. For your consideration, we’ve compiled a list of 219 investments yielding over 5% (we ran a screen requiring 5% yield, $500 million market cap, and $100 million in sales), we’ve broken the list into seven custom big-yield categories, and then we’ve identified eight securities across the categories that we believe represent attractive investment opportunities regardless of the broader market trend.

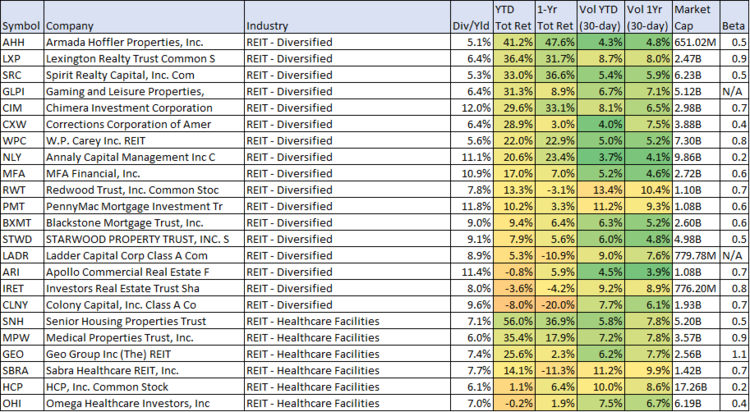

1. REITS

Among the 219 big-yield securities that passed our screen, REITs were the most common. And as the following chart shows, the 50 REITs that passed the screen also tended to exhibit very low volatility.

This combination of big yield and low volatility helps explain REIT popularity and their recent strong performance especially as central banks have kept interest rates so low. For example, an extremely popular REIT among income investor is Realty Income (O). However, given its recent strong performance (it’s up 35% year-to-date) and its high valuation (its price-to-FFO ratio is at a historically high level) we much prefer other REIT opportunities. For example:

HCP Inc. (HCP) is a healthcare REIT that has relatively low volatility, but it has also delivered lower than average returns. HCP has underperformed the market because of difficulties with its largest tenant, HCR ManorCare. However, we believe HCP is prudently working through these challenges by spinning off HCR ManorCare. And once the spin-off is in the rear view mirror, HCP shares will still offer an attractive big yield, low volatility, and the opportunity for big price gains. You can read our recent HCP full report here.

Omega Healthcare Investors (OHI) is another healthcare REIT. It offers an attractive 6.9% dividend yield, and it has NOT delivered the same large price gains as some of its peers (it’s down 3.7% YTD). We believe OHI offers attractive price appreciation opportunities considering its leadership position in the Skilled Nursing Facilities (SNF) Industry. Further, a variety of valuation and risk metrics (mainly Price-to-FFO and dividend payout ratio) suggest the dividend is relatively safe and likely to grow. If you are comfortable with the unique risks of an SNF REIT (like we are), Omega currently offers an outstanding opportunity to buy in at a very attractive dividend yield. You can read our earlier full report on Omega here.