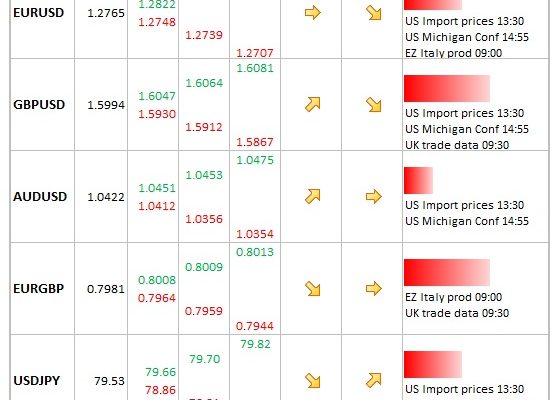

Data/Event Risks

Data/Event Risks

- USD: Â The data stands behind the continued ebb and flow of sentiment in the wake of the election and ahead of the fiscal cliff (whatever form it takes). Generally, Michigan has historically had only muted FX response.

- EUR: Â No scheduled major events for the rest of day, but the focus is on bailout sentiment with finance ministers meeting next week.

- GBP: Trade data more important as Bank of England has been more concerned with impact of stronger currency on economy. Weaker number would knock sterling from better tone.

Idea of the Day

It’s not all about the dollar. EUR/GBP illustrates well the weakness of the euro on the crosses and the break below key trendline seen mid-week set the cross up for a sustained move towards the 0.7924 level seen at the end of September. Even though beset by its own problems, sterling again appears to be gaining a modest safety premium as the single currency buckles under its own problems. Lack of further QE from the BoE yesterday was naturally supportive for sterling.

Latest FX News

- USD: Fiscal cliff debate dominates. For what it’s worth, ratings agency S&P offered 15% chance of US falling over the cliff edge as politicians fail to reach a compromise.

- EUR: Decision on next Greek aid payment won’t be made at next week’s meeting of finance ministers, according to official quoted by Bloomberg, with fuller assessment awaited.

- JPY: Consumer confidence data fell to 39.7 (from 40.1). Yen has so far sustained move below 200d moving average (currently at 79.66). Focus on GDP data next week.

- CNY: Inflation lower than expected (1.7%), Production firmer (from 9.2% to 9.6% YoY) and Retail Sales also stronger (14.2% to 14.5%). Overall modestly positive for risk assets.

- AUD: Reserve Bank of Australia cut 2013 growth forecast on weaker natural resource investment, keeping alive hopes for rate cut, but China news dominated, allowing push back above 1.04.