Many market participants are scratching their head as to whether the low VIX levels are an anomaly or some kind of utopian new normal. JPMorgan’s Quant Derivatives shop warns the current environment is not similar to the great moderation of 2004-2007 as volatility appears to be disconnected from fundamentals and pressured by structural effects, including central bank intervention, low trading volumes, and pressure from option hedging. Crucially, based on an examination of ‘gamma imbalances’, the current (low) volatility regime may change significantly after the June expiry.

As JPMorgan explains…

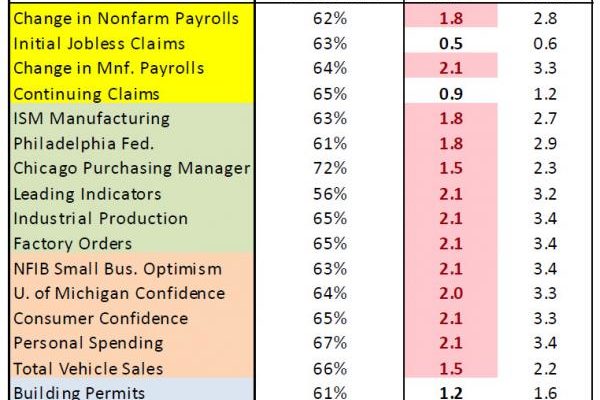

Low Volatility – Anomaly or a New Normal? Many clients have asked us whether the low VIX levels (1M median: 11.7) are an anomaly or a new normal. We have heard analysts arguing that the low volatility is fundamentally justified and the current environment is similar to the 2004-2007 time period. To assess current levels of volatility, we have analyzed the VIX in light of recent Macro data, Volatility of other asset classes, and various structural drivers. Our view is that the current environment is not similar to 2004-2007 as volatility appears to be disconnected from fundamentals, and pressured by structural effects. In our recent report on the VIX, we analyzed the ability of employment, manufacturing, consumer and housing data to forecast the VIX. Most of these macro series indicate that the VIX is about 3 points too low (historical success rate of these forecasts was 60-70%). During the 2004-2007 time period, these same macro models showed the low levels of volatility at the time were fairly priced.

Volatility in other asset classes such as rates, FX, commodities and credit spreads have also been very low.Some of the measures (such as G7 FX, Rates, and Oil volatility) are in fact at absolute all-time lows (VIX is in the 25th percentile of the 2004-2007 low volatility range). The only exception is credit spreads which are moderately higher now than during 2004- 2007. In addition to low levels, most cross-asset volatility time series (85%) have been declining in the last month – a signal that does not point to an imminent increase in volatility.