Earlier this month we got confirmation of something we postulated back in April: that the primary source of revenue for Virtu (which, as a reminder, has had only one losing trading day in six years) is no longer equities but FX. Here’s what we said:

Virtu released its first public financials since going public, and our speculation has been proven correct: FX is now the largest revenue generator for VIRT, amounting to 28.4% of revenues in the quarter ended March 31, at $42.2 million, well above the $29.1 million generated from trading  America Equities and the $34.7 million from global commodities.

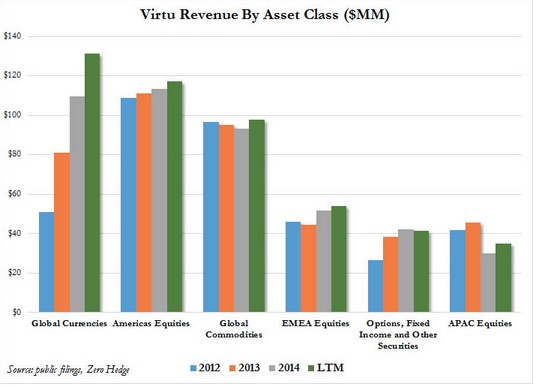

In fact, as the chart below shows, on an LTM basis, FX is now not only the biggest revenue item for the world’s dominant HFT firm at $131.1 million, but is also the fastest growing source of profit, rising 103% on a year over year basis!

Â

Â

Why the shift? Simple:

…with retail now forever done with rigged, manipulated capital markets (at least they get a free drink losing money in a casino) and even banks scrambling to find any volume be it in flow or prop, there is just one remaining “whale” source of dumb money to be front run: central banks. And as everyone knows, central banks trade mostly in the FX arena.

What are the implications? Again, simple:

…with Virtu, whose business model is geared to frontrunning whale orders in any market, irrelevant of their nature, now solely focused on clipping pennies ahead of central bank FX orders, it means that there is no longer any space for retail investors in yet one more market, where market wide stop hunts, squeezes and momentum ignition have become the norm, as the only “traders” left are a few central banks and every single algo that hasn’t cannibalized itself yet.

And so, with the machines having firmly entrenched themselves in FX, and with the world’s central banks engaged in an epic global currency war in an increasingly futile and self-defeating attempt to create demand by printing fiat money, we can expect a wild ride in currency markets going forward or, as we put it more than a year ago, “the next time you feel like the USDJPY is trading as if it is in need of a software update, you will be right.â€