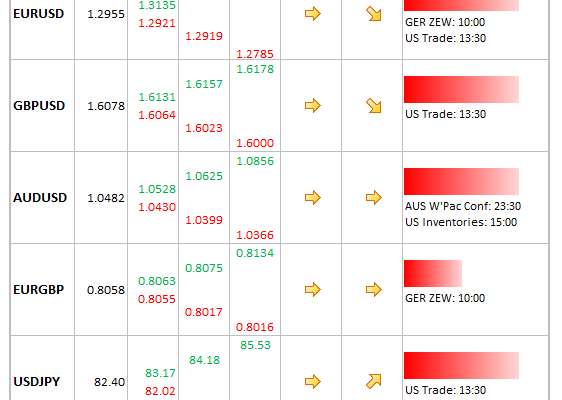

Data/Event Risks

Data/Event Risks

- EUR: Apart from the German ZEW index, little to really excite today. German and French CPI early tomorrow.

- GBP: Jobs data tomorrow will be the main focus – the suspicion is that the evident strength apparent this year may be fading. Still, cable has a remarkable bid tone. See how to trade the UK employment data with GBPUSD.

- USD: Not much out today other than trade figures. Market awaits FOMC outcome tomorrow (see the preview here), Fed likely to announce more asset purchases to coincide with expiration of Operation Twist. Some hints that the two sides in the fiscal cliff debate are moving nearer to a deal.

Idea of the Day

Currency markets are very much in holiday mode as witnessed by the benign responses to economic news over recent days. Not even a sense of renewed political instability in Italy could stir the euro’s juices yesterday, although it did impact bond yields and stocks. For choice, the Aussie still looks bid, although the issue here is that the RBA is sitting on top. The greenback needs resolution of the fiscal cliff to help trigger a push to the topside.

Latest FX News

- EUR: The euro completely ignored much higher Italian bond yields, soft OECD leading indicators for Germany/euro-area and weak I/P data out of France, reaching 1.2963 overnight. Some suggestion that traders were stop-hunting yesterday.

- GBP: Had a healthy bid all day, for no good reason that was easy to discern – cable reached 1.61 after threatening 1.60 earlier.

- GOLD: Has recovered well after looking very wobbly in the second half of last week. The bears have retreated for now, amidst repeated failures to break the USD 1,690 level.

- AUD: Traded above 1.05 briefly yesterday but failed to sustain and has since drifted back to 1.0480. Has been trapped in an incredibly narrow 1.0440-1.0500 band for over a week now. Still, there is a sense that at some stage the upside will be tested. Shrugged off weak business confidence figures overnight.