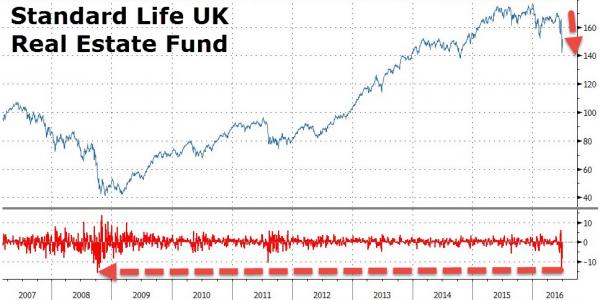

In the summer of 2007, two inconsequential Bear Stearns property-related funds were gated and then liquidated, exposing the reality of the US housing bubble and catalyzing the collapse of the financial system. While equity markets have rebounded exuberantly post-Brexit, suggesting all is well, British property-related assets have tumbled and, as The FT reports, Standard Life has been forced to stop retail investors selling out of one of the UK’s largest property funds for at least 28 days after rapid cash outflows were sparked by fears over falling real estate values. As one analyst warned, “the risk is this creates a vicious circle, and prompts more investors to dump property.”

Standard Life Investments has suspended trading on its £2.7 billion U.K. Real Estate fund, effective immediately, following Brexit, Investment Week reported, citing a statement.

The firm has suspended trading on the SLI UK Real Estate PAIF and the SLI UK Real Estate income and accumulation feeder funds.

The company cites “exceptional market circumstances” following an increase in redemption requests from the referendum.

The drop in NAV is the largest since Lehman…

The £2.9bn commercial property fund will need to sell real estate to raise cash before any money can be redeemed.

And, as The FT reports, the last property crash in the UK in 2007 was preceded by a wave of similar gatings by funds struggling to meet investor demands for cash. They led to firesales of property that added to the pressure on an already falling market.

Last week, Standard Life was one of a handful of UK open-ended property funds to mark down the value of the buildings they own by 5 per cent in the wake of the UK’s vote to leave the EU.

In another sign of stress in the sector, some closed-ended property trusts are trading at discounts of more than 10 per cent to their net asset value, which reflects fears over the future of commercial property.

“Given the outflows the sector seems to be experiencing, this could well put downward pressure on commercial property prices,â€Â said Laith Khalaf, senior analyst at Hargreaves Lansdown. “The risk is this creates a vicious circle, and prompts more investors to dump property, until such time as sentiment stabilises.â€