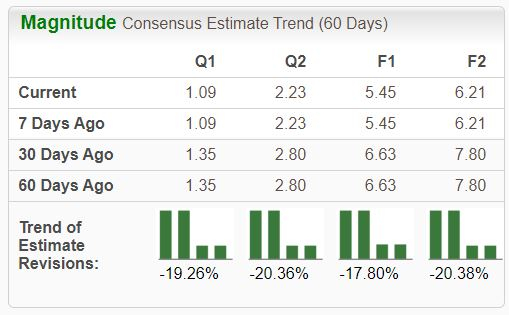

Dollar Tree (), a discount retailer, offers a wide range of quality everyday general merchandise in many categories, including housewares, seasonal goods, candy, food, toys, health and beauty care, and many other consumer items.Analysts have taken a bearish stance on the stock’s outlook, lowering their earnings expectations across the board and pushing it into an unfavorable Zacks Rank #5 (Strong Sell).(Click on image to enlarge) Image Source: Zacks Investment ResearchIn addition, the company is in the Zacks Retail – Discount Stores industry, which is currently ranked in the bottom 25% of all Zacks industries. Let’s take a closer look at the company. DLTR Faces Post-Earnings PressureDLTR’s recent quarterly results haven’t been positive, with the company falling short of the Zacks Consensus EPS estimate by an average of 11% across its last four releases. Concerning its latest print, Dollar Tree fell short of both consensus earnings and revenue expectations, with EPS falling nearly 30% alongside a modest 0.7% sales increase.Down nearly 50% in 2024, shares have regularly faced post-earnings selling pressure.(Click on image to enlarge)

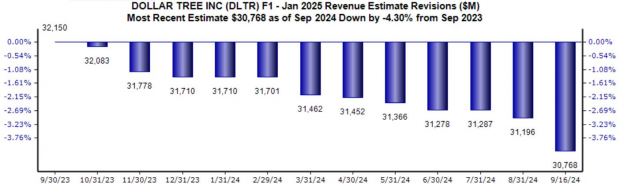

Image Source: Zacks Investment ResearchIn addition, the company is in the Zacks Retail – Discount Stores industry, which is currently ranked in the bottom 25% of all Zacks industries. Let’s take a closer look at the company. DLTR Faces Post-Earnings PressureDLTR’s recent quarterly results haven’t been positive, with the company falling short of the Zacks Consensus EPS estimate by an average of 11% across its last four releases. Concerning its latest print, Dollar Tree fell short of both consensus earnings and revenue expectations, with EPS falling nearly 30% alongside a modest 0.7% sales increase.Down nearly 50% in 2024, shares have regularly faced post-earnings selling pressure.(Click on image to enlarge) Image Source: Zacks Investment ResearchThe company trimmed its current-year sales guidance following its latest release, helping explain the post-earnings share plunge. Analysts have revised their sales expectations accordingly as well, with the $30.1 billion expected for its current fiscal year (FY24) down 4% over the last year and reflecting a marginal 0.3% Y/Y climb.(Click on image to enlarge)

Image Source: Zacks Investment ResearchThe company trimmed its current-year sales guidance following its latest release, helping explain the post-earnings share plunge. Analysts have revised their sales expectations accordingly as well, with the $30.1 billion expected for its current fiscal year (FY24) down 4% over the last year and reflecting a marginal 0.3% Y/Y climb.(Click on image to enlarge) Image Source: Zacks Investment ResearchA key piece of the Dollar Tree story lies in their consumer demographics. As a discount retailer, the company attracts many lower-income consumers looking for value, but the company is also more susceptible to economic slowdowns when these types of consumers get pinched the most. Bottom LineNarrowed guidance and weak quarterly results paint a challenging picture for the discount retailer’s shares in the near term.Dollar Tree is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.More By This Author:3 Red Hot Stocks Flashing Buy Signals: DaVita, Intuitive Surgical, SharkNinja3 Big Winners From The Q2 Earnings Season: LLY, LMT, METANvidia Earnings: What You Should Know

Image Source: Zacks Investment ResearchA key piece of the Dollar Tree story lies in their consumer demographics. As a discount retailer, the company attracts many lower-income consumers looking for value, but the company is also more susceptible to economic slowdowns when these types of consumers get pinched the most. Bottom LineNarrowed guidance and weak quarterly results paint a challenging picture for the discount retailer’s shares in the near term.Dollar Tree is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.More By This Author:3 Red Hot Stocks Flashing Buy Signals: DaVita, Intuitive Surgical, SharkNinja3 Big Winners From The Q2 Earnings Season: LLY, LMT, METANvidia Earnings: What You Should Know

Bear Of The Day: Dollar Tree