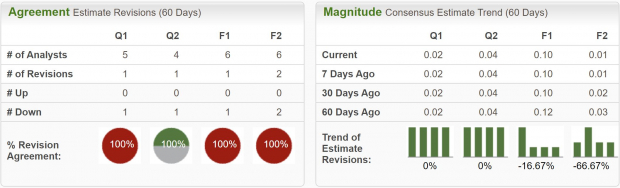

Altice USA (), one of the country’s largest broadband communications and video services providers has struggled in recent years due to intense competition and shifting consumer trends. Topline sales have fallen in recent years, while earnings have recent flipped negative and huge debt obligations stress financial security.Altice USA stock has cratered over the last five years, falling 91.9% and massively underperforming the broad market and its respective industry. Though the company maintains a huge customer base, numerous products and considerable infrastructure, the company has faced challenges, including customer service issues and competition from other telecom and streaming service providers.Furthermore, ATUS has a Zacks Rank #5 (Strong Sell) rating, indicating falling earnings estimates and further increasing the odds of another move lower in the stock price. Based on this setup, investors should avoid Altice USA stock until its outlook improves. Image Source: Zacks Investment Research Altice USA Earnings Estimates PlungeQuarterly earnings reports continue to disappoint with the last three missing estimates and the most recent quarter missing earnings forecasts by a whopping -62.5%. Analysts have been steadily downgrading earnings estimates since mid-2021 and continue to do so today.FY24 earnings estimates have been lowered by -16.7% over the last two months and are projected to fall 16.7% YoY, while FY25 earnings estimates have declined by 66.7% and are expected to crater 89.2%. Sales forecasts aren’t any better with the top line expected to contract 2.8% this year and 2.9% next year.(Click on image to enlarge)

Image Source: Zacks Investment Research Altice USA Earnings Estimates PlungeQuarterly earnings reports continue to disappoint with the last three missing estimates and the most recent quarter missing earnings forecasts by a whopping -62.5%. Analysts have been steadily downgrading earnings estimates since mid-2021 and continue to do so today.FY24 earnings estimates have been lowered by -16.7% over the last two months and are projected to fall 16.7% YoY, while FY25 earnings estimates have declined by 66.7% and are expected to crater 89.2%. Sales forecasts aren’t any better with the top line expected to contract 2.8% this year and 2.9% next year.(Click on image to enlarge) Image Source: Zacks Investment Research Altice’s Debt BurdenAltice USA’s financial struggles are compounded by its massive debt load, which has created additional pressures on the company’s ability to operate effectively. As of the latest reports, Altice carries over $24 billion in debt, a substantial figure that severely limits its financial flexibility. Interest payments on this debt have eaten into profit margins, making it even harder for Altice to reinvest in necessary upgrades to its network infrastructure, customer service, and product offerings.In the face of growing competition and customer churn, this financial strain becomes even more significant. The company’s inability to significantly grow revenues or improve customer retention makes servicing this debt increasingly difficult. As a result, Altice’s financial health has continued to deteriorate, contributing to the dramatic decline in its stock price. Should Investors Avoid ATUS Stock?Given Altice USA’s dismal financial performance, mounting debt, and negative earnings revisions, it’s hard to justify an investment in the stock right now. The company is battling significant headwinds, from intense competition to a shrinking subscriber base and declining revenues. While its large customer base and extensive infrastructure are assets, they haven’t been enough to offset the broader challenges it faces.For investors looking for opportunities in the telecom space, there are other companies with stronger fundamentals, growth prospects, and less financial strain. Until Altice can turn around its earnings trajectory and stabilize its business, it’s a stock better left avoided.More By This Author:Should Investors Buy JPMorgan Stock Ahead Of Q3 Earnings?Top Analyst Reports For Meta Platforms, Cisco & Philip MorrisBlackRock Stock Drops Despite Market Gains: Important Facts to Note

Image Source: Zacks Investment Research Altice’s Debt BurdenAltice USA’s financial struggles are compounded by its massive debt load, which has created additional pressures on the company’s ability to operate effectively. As of the latest reports, Altice carries over $24 billion in debt, a substantial figure that severely limits its financial flexibility. Interest payments on this debt have eaten into profit margins, making it even harder for Altice to reinvest in necessary upgrades to its network infrastructure, customer service, and product offerings.In the face of growing competition and customer churn, this financial strain becomes even more significant. The company’s inability to significantly grow revenues or improve customer retention makes servicing this debt increasingly difficult. As a result, Altice’s financial health has continued to deteriorate, contributing to the dramatic decline in its stock price. Should Investors Avoid ATUS Stock?Given Altice USA’s dismal financial performance, mounting debt, and negative earnings revisions, it’s hard to justify an investment in the stock right now. The company is battling significant headwinds, from intense competition to a shrinking subscriber base and declining revenues. While its large customer base and extensive infrastructure are assets, they haven’t been enough to offset the broader challenges it faces.For investors looking for opportunities in the telecom space, there are other companies with stronger fundamentals, growth prospects, and less financial strain. Until Altice can turn around its earnings trajectory and stabilize its business, it’s a stock better left avoided.More By This Author:Should Investors Buy JPMorgan Stock Ahead Of Q3 Earnings?Top Analyst Reports For Meta Platforms, Cisco & Philip MorrisBlackRock Stock Drops Despite Market Gains: Important Facts to Note

Bear Of The Day: Altice USA