Although many stocks have started to participate in the broader end-of-the-year rally, Align Technology ( – ) looks like one to avoid right now.Mostly attributed to a weakening outlook, it’s noteworthy that Align Technology’s Zacks Medical-Dental Supplies Industry is currently in the bottom 7% of over 250 Zacks industries.Despite the company’s favorable long-term prospects as a provider of Invisalign clear aligners for the treatment of malocclusions or the misalignment of teeth, Align Technology’s stock currently lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

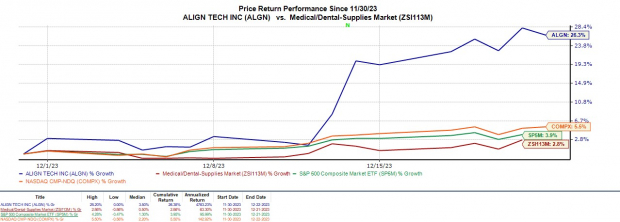

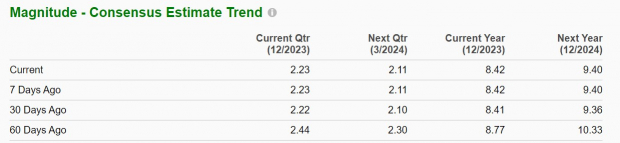

Time for a Cooldown Amid Declining Earnings EstimatesConsidering most of Align Technology’s +28% year-to-date gains came over the last month its stock certainly looks do for a correction or pullback as earnings estimate revisions are still noticeably lower in the last 60 days.(Click on image to enlarge) Image Source: Zacks Investment ResearchFiscal 2023 earnings estimates are down -3% over the last two months from $8.77 per share to $8.42 a share. More concerning, FY24 EPS estimates have dropped -9% from $10.33 per share to $9.40 a share.(Click on image to enlarge)

Image Source: Zacks Investment ResearchFiscal 2023 earnings estimates are down -3% over the last two months from $8.77 per share to $8.42 a share. More concerning, FY24 EPS estimates have dropped -9% from $10.33 per share to $9.40 a share.(Click on image to enlarge) Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Unsupportive ValuationWith a current stock price of $270, Align Technology’s valuation doesn’t support its extensive rally over the last month trading at a 32.5X forward earnings multiple which is now noticeably above its industry average of 20.3X and the S&P 500’s 22.2X.(Click on image to enlarge) Image Source: Zacks Investment ResearchFurthermore, Align Technology’s price-to-sales ratio of 5.4X is uncomfortably above the optimum level of less than 2X and a very stretched premium to its industry average of 0.4X and even the S&P 500’s 3.9X.(Click on image to enlarge)

Image Source: Zacks Investment ResearchFurthermore, Align Technology’s price-to-sales ratio of 5.4X is uncomfortably above the optimum level of less than 2X and a very stretched premium to its industry average of 0.4X and even the S&P 500’s 3.9X.(Click on image to enlarge) Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

TakeawayUndoubtedly, investors are hoping the end-of-the-year rally can continue for the broader stock market but the recent spike in Align Technology shares appears to be overdone. It may be wise to fade the rally in Align Technology’s stock or stay on the sidelines until better opportunities present themselves.More By This Author:Momentum Alert: 2 Top Ranked Stocks Breaking Out NowPick These 4 Stocks With Solid Interest Coverage Ratio7 Market Predictions For 2024

Bear Of The Day: Align Technology