Data/Event Risks

Data/Event Risks

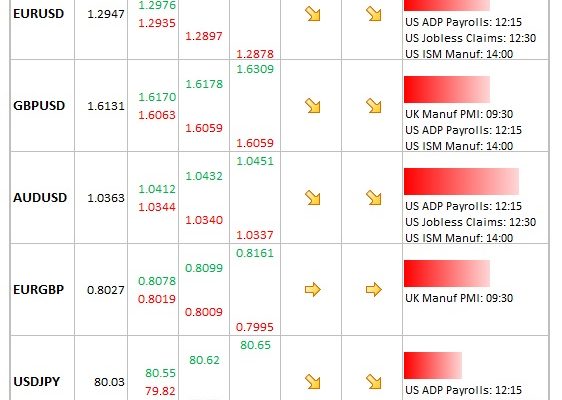

- USD: Tighten your seat belts, the economic releases come thick and fast today. Challenger job cuts at 11:30, jobless claims at 12:30, ISM manufacturing at 14:00, and vehicle sales at 21:00. So plenty of labour market data ahead of the main event, non-farm payrolls at 12:30 tomorrow.

- EUR: Less eventful today, with PMIs out of both Spain and Greece. All eyes on US economic news. Greek situation needs to be watched closely, as still unresolved.

- GBP: PMI manufacturing at 09:30 is the only event of note this morning. If it prints with a 49 handle, this will help the pound.

Idea of the Day

Currency volatility will increase in coming days, with a lot of tier 1 economic data to be released and then the US presidential election next Tuesday. Rather than looking for a trend to emerge in the dollar, the best approach may be to stay opportunistic and fleet-footed in response to news.

Latest FX News

- USD: Soft for a time yesterday, before month-end flows came to the rescue leading up to the 4:00pm London fix. The dollar index is back at 80 but is having great difficulty penetrating on a sustained basis. A critical time for the dollar over coming days. Â

- EUR: Had a healthy bid yesterday morning after decent consumer spending out of Germany & France, but faded once it met a wall of sellers at 1.30. Not helping the euro was hawkish defiance from Greek Democrat Party leader, Kouvelis, who claimed troika’s demands were too harsh.

- JPY: A poor night for the Japanese currency, with losses against all of the majors. USD/JPY is back above 80, while GBP/JPY is up at 129.

- AUD: The bulls had been in charge over recent days, but the Aussie ran into a wall of sellers up at 1.04 and fell back progressively from there. Next big events for the Aussie are the RBA and US presidential election.