Like many mortgage real estate investment trusts (REITs), AG Mortgage Investment Trust (NYSE: MITT) has a high yield that is attractive to investors.

At 9.8%, it’s easy to understand why investors would look at the stock – and why Wealthy Retirement readers would want to know if the dividend is safe.

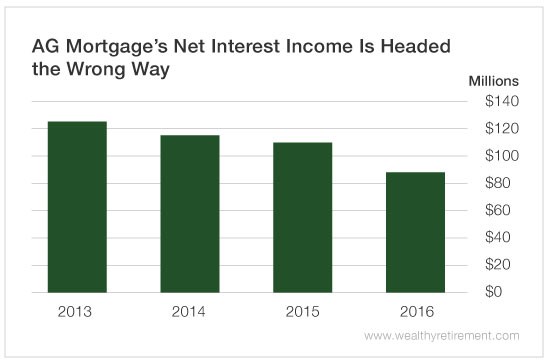

The most important metric we look at with mortgage REITs is net interest income. Mortgage REITs make money by borrowing money at short-term rates and lending it out long term. The difference is the net interest income.

And this key metric is headed in the wrong direction.

Net interest income has fallen each year between 2013 and 2016. This year, it’s expected to head lower still…

(Click on image to enlarge)

And in the first three quarters of this year, net interest income is down 5% over the same period last year. So it appears that 2017’s total will likely be another down year.

The good news is that net interest income covers the dividend. Last year, the company paid out $67 million in dividends while generating $89 million in net interest income. This year it has paid out $50 million while generating $62 million in net interest income.

But the company has also cut the dividend, even when net interest income covered it. Twice in the past five years, management has reduced the payout to shareholders.

A company that has cut the dividend before has made it clear that the dividend is not sacred. It will likely be cut again if things get rough.

A history of dividend cuts with net interest income declining every year is not a combination for a safe dividend.

Dividend Safety Rating: F