Barclays CEO Jes Staley is up to no good in Davos, what with all this talk about 2005 and 2006 and warning about complacency and so on and so forth.

That’s the kind of thing that will get you ostracized in a market where everyone has spent the last six months making their own list of reasons why “this time is differentâ€.

“Given asset valuations, given that we’ve got 4% global economic growth it seems we’re in a pretty good place right now economically,†Staley said earlier this week, during a panel discussion. “But, we’ve got a monetary policy that’s still in the remnants of the depression era. We’ve got very little capacity in the capital markets to deal with a real move in interest rates.â€

During that same discussion he called on regulators to save the industry from itself because, and this is a quote, “in my almost 40 years in finance, we’ve never avoided the next financial crisisâ€. Thanks for your candor Jes and as far as regulation, you can count on Trump – to deregulate the most important financial market on the planet.

Anyway, Staley spoke to CNBC on Thursday and wouldn’t you know it, Jes is worried about Seth Golden (and anyone else shorting vol. in their underwear from their living room).

“Asset values are at all-time highs … and almost even more concerning than that — a lot of what’s driving that low in volatility is people are selling volatility,†he said, adding that “if you’ve got a lot of short positions at an all-time low level and something snaps, the velocity of recovery could be quite something to watch.â€

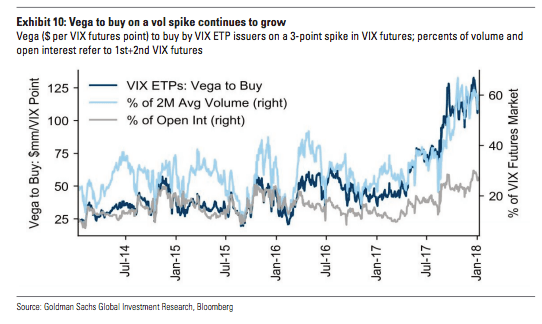

Why yes it could Jes, and it seems like maybe you have grasped the rebalance risk or the vega-to-buy on a given spike in the VIX futures curve which, at last check, was sitting at roughly $110 million for just a 3-point move:

Here’s the clip:

As you can see, he also warns about the possibility that an uptick in inflation catches central banks behind the curve causing them to roil markets. It’s almost – almost – like this fucker gets it.