Barclays shares jumped Thursday after the DOJ handed the UK bank a major victory in its years-long struggle to settle allegations of malfeasance dating back to the financial crisis. As part of the deal, Barclays has agreed to pay a $2 billion civil penalty to settle allegations of fraudulent conduct relating to Barclays’ securitization, underwriting, and sale of RMBS in 2005-2007.

The DOJ sued Barclays for fraud back in December 2016 after the bank refused to pay a much larger fine sought by the Obama administration. Last year, Bloomberg reported that the bank wouldn’t pay more than $2 billion to settle the matter. Conveniently, the Trump DOJ was more amendable to its demands, and additionally, the civil settlement will save the bank from a lengthy trial.

Additionally, two former Barclays executives have agreed to pay $2 million as part of the settlement, which comes after two former Barclays traders were acquitted in a retrial on charges they plotted to rig Libor.

The good news for Barclays, is that the settlement resolves all outstanding DOJ civil claims; the only downside is that it will negatively, if modestly, impact Barclays’ Common Equity Tier 1 ratio as of Dec. 31, 2017, by about 45 basis points, although not enough to impair the bank’s ability to pay a dividend, and the bank confirmed its intention to pay shareholders 6.5p for 2018.

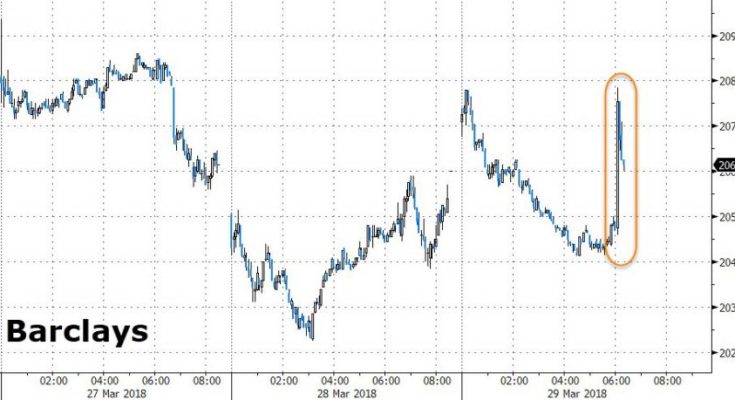

Barclays shares spiked to their earlier highs on the news, but the move has since faded a bit.

Â

The DOJ’s full statement below: