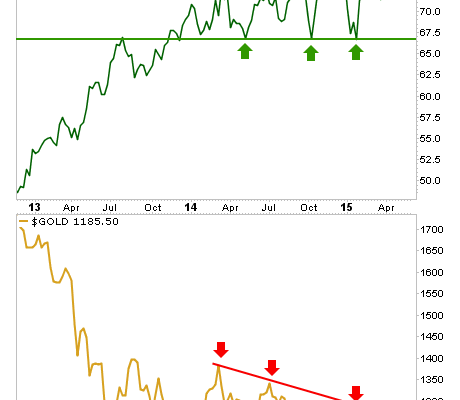

An update of the situation on the Banks, the anti-Banks (gold) and the yield relationships that would help define their fates.

The Bank index is breaking through resistance this week while gold remains in Palookaville.  Note to certain bloggers out there who would nitpick: the arrows are not meant to line up (green to red); they are meant to show support and resistance for the Banks’ lows and Gold’s highs, respectively.

Â

During the last interest rate mini-hysteria we talked about a possible return of a ‘carry’ trade involving the Fed’s oh so generous ZERO money at the discount window and the Banks’ ability to gorge on this, mark it up and spin it out into the economy. Presto… instant profit margins!

Many people talk about rising interest rates being bearish for gold and indeed, they can be. Here is the 30 year yield daily view… whoa, that looks bullish.

Â

Now let’s add definition to the picture. Here is the same yield on the monthly time frame with the ‘Continuum’ © simply continuing. It can continue all the way up to 3.6% interest without changing a thing on the bigger macro.

Â

At the beginning of the last hysterical bounce (that ended with the most recent red arrow) we noted the potential for a favorable ‘carry’ by the Banks. Then it all sagged like a bad souffle into the latest global deflationary sink hole from late 2013 to the end of 2014.

Not coincidentally, so did the Banks’ leadership to the S&P 500. A downtrend channel has been in play for that ratio ever since. The lower panel of the chart shows the nominal 30 year yield on a bounce. If it is to register the 3.6% target then BKX would probably break the post-2013 downtrend channel and resume market leadership.

Â

As for gold, it can do well in a rising interest rate environment, but only if an inflation problem is implied by the rise in yields. One way to view that would be through certain inflation gauges, one of which is the spread between inflation protected US Treasury bonds (TIPS) and unprotected long-term bonds (TLT).