Banks should do well in 2015, thanks to economic growth and higher interest rates, which will boost spreads even for liability-sensitive banks.

The economy will expand throughout 2015 (as described in more detail in Economic Forecast 2015-2017), prompting the Federal Reserve to boost short-term interest rates in the spring or summer. It is a good environment for credit quality, though most bank loans are now in very good condition.

Loan volumes will improve, and this is a major positive for commercial banks. Consumers will continue to grow their credit, but only in pace with their overall income. Look for four-to-five percent consumer loan growth. The big gains will be in commercial and real estate loans.

Commercial and industrial loans have three triggers: accounts receivable, inventories and capital spending. Receivables will grow along with the overall economy, about five percent. Inventories will probably grow just a little faster, as inventories grow or contract on more than a one-for-one basis with the overall economy. Capital spending, however, will be the largest force for greater C&I volumes. Businesses are loosening their purse strings and will do so even more in 2015.

Real estate lending will improve markedly on the residential side. With the boom’s excess supply nearly worked off, new housing construction must match the needs of a growing population, meaning at least a 20 percent gain in starts. Non-residential activity will only grow modestly, though, as vacancy rates are still pretty high in most markets.

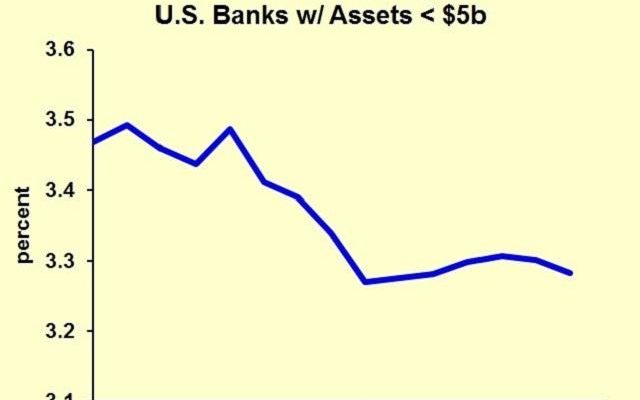

The other big impact on bank profits will be the interest rate spread. As interest rates increase on Federal Funds and treasuries, deposit rates will not rise much. That is because banks have so much in excess deposits that they won’t compete hard to keep deposits, as I explained in How Will Fed Tightening Impact Community Banks? Banks and credit unions will probably boost deposit rates by just five or ten basis points during the first 100 basis point increase in Fed Funds. Loans will reprice one-for-one with market rates, so that will add 90 basis points or so to spreads for banks with neutral balance sheets. In this environment, even a liability-sensitive bank will profit.