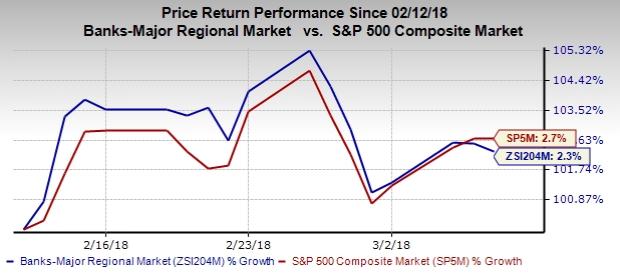

Over the last five trading days, performance of banking stocks remained optimistic. Rebound in trading activities (after dismal 2017 performance) is perhaps the primary reason for this bullish price performance.

Banks like Citigroup C and JPMorgan JPM expect trading revenues to improve in first-quarter 2018. This is likely to be driven by solid revenues in foreign exchange, emerging markets and equities trading. Specifically, Citigroup expects “low-to-mid†single digit year-over-year increase in trading revenues and JPMorgan projects market revenues to rise in mid-to-high single-digit rate from the prior-year quarter.

Additionally, progress in rolling back parts of the Dodd-Frank Act cheered investors. The Senate is working on a bipartisan banking bill expected to lower stringent banking regulations. This will likely reduce regulatory compliance cost for several banks.

On the other hand, mortgage rates continued to rise, with 30-year mortgages averaging 4.46% (marking the ninth consecutive weekly increase). The rise seems to be attributable to chances of rate hike later this month and impending trade war following the imposition of tariffs. This steady rise in mortgage rates will limit refinancing activity, thereby hurting banks mortgage banking revenues to some extent.

Coming to company-specific news related to banks, business misconducts continued to dominate headlines for Wells Fargo WFC.

(Read: Bank Stock Roundup For the Week of March 2)

Important Developments of the Week

1. William Galvin, the top securities regulator of Massachusetts, announced that his office has started investigating the wealth management arm of Well Fargo to see if the division has been steering rollover money into managed accounts or if its employees have been making investment recommendations to clients that are unsuitable for them according to their needs.

This investigation comes almost a week after Wells Fargo, in its 10K filling revealed that it was conducting an internal review to assess whether there had been unjustified referrals or recommendations, including with respect to rollovers for 401(k) plan participants, certain alternative investments and referrals of brokerage customers to the bank’s investment and fiduciary services business.