The Bank of England (BoE) has bitten the bullet and hiked the base interest rate from 0.25% to 0.5%, but in a dovish turn also provided forward guidance that outlines a very gradual path for future hikes. This was a close call with compelling arguments in favor and against. We are in the against camp and, looking ahead, we expect the BoE will have to stand down. We believe that a one-and-done rate hike against such a dovish forward guidance background will only briefly impact markets, pushing down gilt yields and the pound and supporting equities.

Arguments in favor of the rise

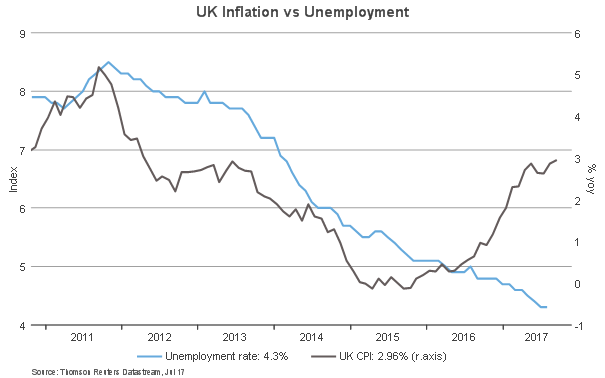

The arguments in favor of the interest rate hike start with the rise in inflation to 3% year-on-year. This is putting pressure on the BoE to tighten monetary policy. However, because the rise in inflation is mainly caused by a fall in the pound, it is not the main reason. After all, the inflationary impact of a lower pound is transitory and will slowly dissipate in 2018. More important for the BoE is the tight labor market. The unemployment rate is at its lowest level since 1975 and the BoE worries this will drive future wage growth up. Finally, economic growth in the UK has held up better than expected since the Brexit vote. This undermines the case behind the BoE’s emergency measures, including its rate cut at the time.

Arguments against the rise

Although the arguments in favor are compelling, we are of the opinion that the arguments against are more so. As stated before, concerns around inflation need to be tempered considering the transitory impact of a weaker pound. And although wage growth might indeed pick up in the future, as of late it has been rather sluggish. In fact, in real terms wage growth has dipped into negative territory, putting pressure on UK consumers. And because the consumer has been the engine of economic growth since the Brexit vote, it follows that risks to the economy are tilted to the downside. In an environment where economic growth is already slowing down notably and the important housing market is wobbly, we disagree with the BoE decision to add to those risks.