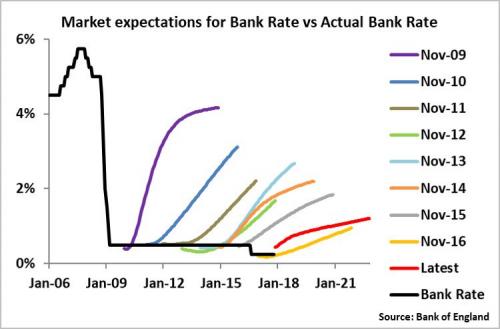

Over ten years since the last rate hike by the Bank of England in July 2007 (when incidentally, cable was trading above $2.00), and following years of market expectations of an imminent rate hike that failed to materialize…

…. moments ago the BOE – which had telegraphed the move extensively in recent months despite some dovish misgivings – finally pulled the trigger, and raised rates by 25bps to 0.5% in order to curb the effect of high inflation brought about by the post-Brexit plunge in the pound, squeezing local households and pressuring the UK economy. However, while cable initially spiked higher on the news, it subsequently slumped on the news that the vote was not a unanimous 9-0 decision as some had expected, as would telegraph a normal rate hike cycle, and instead had a decidedly dovish tilt with a far more contested 7-2 vote, with Cunliffe and Ramsden dissenting based on insufficient evidence that domestic costs, particularly wage growth, would pick up in line with central projections.

Here is the BOE assessment:

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment.At its meeting ending on 1 November 2017, the MPC voted by a majority of 7-2 to increase Bank Rate by 0.25 percentage points, to 0.5%.The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion.The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

Some other key BOE considerations:

- Growth:Â GDP grows modestly over the next few years at a pace just above its reduced rate of potential.Business investment is being affected by uncertainties around Brexit, but it continues to grow at a moderate pace, supported by strong global demand, high rates of profitability, the low cost of capital and limited spare capacity.

- Consumption:Â Consumption growth remains sluggish in the near term before rising, in line with household incomes

- Trade:Â Net trade is bolstered by the strong global expansion and the past depreciation of sterling.Â

- Inflation: After CPI rose to 3.0% in September, the MPC still expects inflation to peak above 3.0% in October, as the past depreciation of sterling and recent increases in energy prices continue to pass through to consumer prices. Expects domestic inflationary pressures to gradually pick up as spare capacity is absorbed and wage growth recovers.

- Wages:Â The central projection was that whole-economy total pay growth was expected to rise from a little over 2% to 3% in a year’s time, levelling out at around 3.25% in the medium term.

- Brexit:Â Uncertainties are weighing on domestic activity, which has slowed even as global growth has risen significantly.Brexit-related constraints on investment and labour supply appear to be reinforcing the marked slowdown that has been increasingly evident in recent years in the rate at which the economy can grow without generating inflationary pressures.

- Slack:Â slack has reduced the degree to which it is appropriate for the MPC to accommodate an extended period of inflation above the target