For the past several weeks it felt as if Bank of America’s chief technician, MacNeill Curry (or at least his clients) had an infinite balance sheet to fund relentless P&L losses, resulting from his daily recommendation to short the 10 Year, which contrary to the best wishes of the Fed and the sell-side penguins constantly refused to go lower and validate the “economy is getting better” thesis. Today, even his TBTF balance sheet finally ran out, and moments ago he finally capitulated, and was stopped out on his TYU4 short.

From Bank of America:

Stopped out of TYU4 short. We are now neutral Treasuries

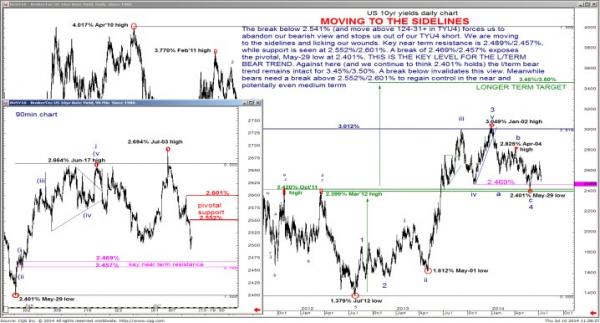

The break above 124-31+ in TYU4 and the push below 2.541% in 10yr yields has stopped us out of our TYU4 short and forced us to abandon our bearish Treasury view. Bigger picture, the long term bear trend remains intact absent a 10yr yield break of the May-29 low at 2.401%. However, for now we move to the sidelines. Immediate resistance is seen at 2.489%/2.464%, while bears need a break 2.552%/2.601% to gain control. Meanwhile we remain in our 5s30s flattener.Â

Of course, this means that now, finally, the time to short the 10Y may have arrived.