The gain in home prices has been widespread, with prices up on an annual basis in all 20 metropolitan areas surveyed. However, the improvement has been particularly notable in certain markets, which have disproportionately pulled up the national composite. The areas with the fastest home price appreciation have generally been those that have attracted the greatest amount of investor buying. As investor demand wanes in these markets, home price appreciation slows.

…

Surfs up

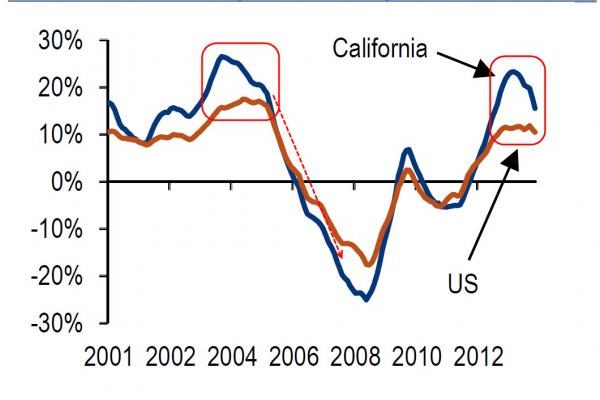

The trend in home prices in California is particularly important when gauging the risks to national home prices.

About 10% of the national housing stock is in California; it is about 20% if measured by the value of the owner occupied housing stock. Home prices also tend to be more volatile in California than the nation and seem to be an early indicator of the turns in the overall market. As Chart 5 shows, home prices in California have recently peaked at 23% yoy in August and have slowed to the current pace of 15.6% yoy

If history is a guide, this suggests a slowdown in national prices is coming. This is consistent with our forecast. We are looking for the pace of home price appreciation to be nearly half of the current 10.5% pace by the end of the year.