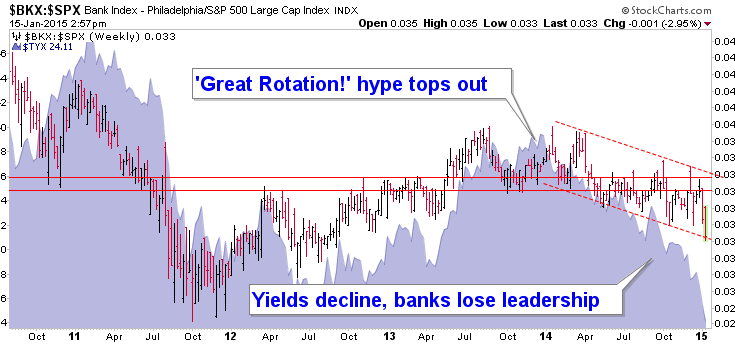

The Banks (BKX) have been leading the broad US stock market (SPX) down into this bumpy ride as T bond yields tank ever further. While the intermediate picture features varying measures of tanking inflation expectations, economic deceleration and other features of a counter cyclical atmosphere, it may be time for T bond yields to bounce and it may be time for bank leadership to bounce, within its downtrend channel at least.

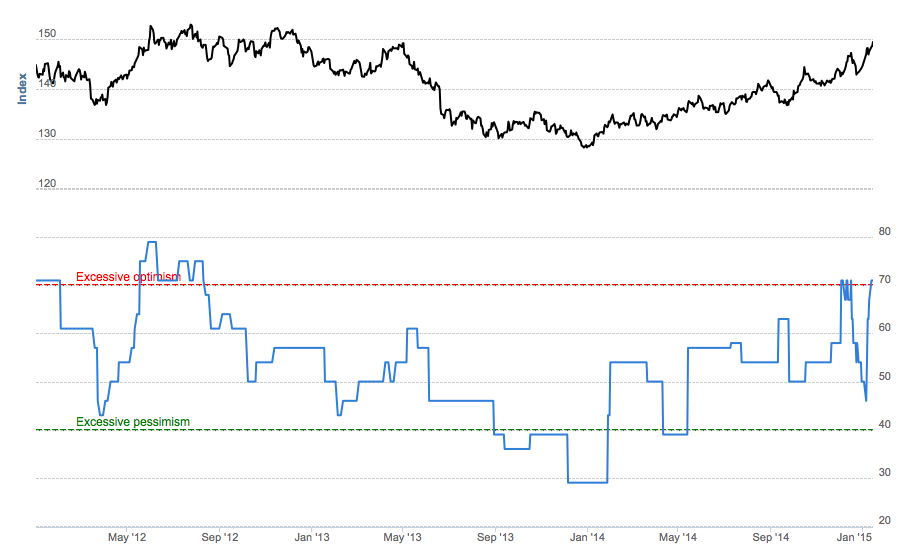

Here look, the public absolutely loves long-term T bonds now after eating the ‘Great Rotation’ hype (bearish bonds) hook, line and sinker a year ago.

30 year T bond Optix from Sentimentrader

Deflation hysterics are over done and I think that long-term T bonds are a short now and the banks just might be a long, depending on how the broad market does here at critical support. We’ll know soon.