(Click on image to enlarge)

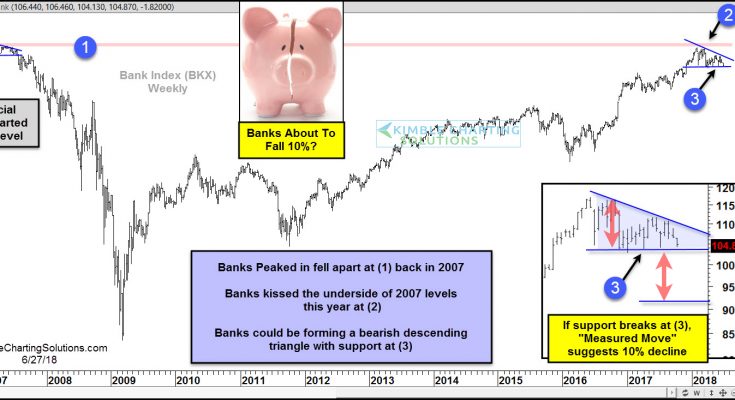

The above chart looks at the Bank Index (BKX) over the past 11-years. At this time the “trend on banks remains Up!â€

This very important index peaked in 2007 at (1), before breaking support and then falling hard for the next couple of years.

The rally over the past 9-years saw the index come back to 2007 levels a few months ago, where it started turning lower, just under line (1), at (2).

Over the past 5-months, the Bank Index could be creating a bearish descending triangle, with the support of the pattern coming into play at (3).

If support would happen to give way at (3), the “Measured Move†suggests that banks could fall at least 10%.

As mentioned earlier, the trend in the bank index at this time remains up. If support would break at (3), it would send a negative message to this important sector.