The Australian Dollar (AUD) edges higher against the US Dollar (USD) after the release of the domestic Purchasing Managers Index (PMI) on Thursday. Additionally, the AUD/USD pair gained as the USD weakened slightly, driven by a modest dip in US Treasury yields. 2-year and 10-year yields on US Treasury bonds stand at 4.07% and 4.23%, respectively, at the time of writing.The AUD could get further support from the prevailing hawkish sentiment surrounding the Reserve Bank of Australia (RBA), bolstered by the positive employment data. Earlier this week, RBA Deputy Governor Andrew Hauser noted that the labor participation rate is remarkably high and emphasized that while the RBA is data-dependent, it is not data-obsessed.The US Dollar faced downward pressure following the release of the Federal Reserve’s (Fed) Beige Book on Wednesday. The latest report indicated that economic activity was “little changed in nearly all Districts,” in contrast to August’s report, where three Districts reported growth and nine showed flat activity.

Daily Digest Market Movers: Australian Dollar receives support from the hawkish mood surrounding the RBA

Technical Analysis: Australian Dollar remains below 0.6650, close to six-week lows

The AUD/USD pair trades around 0.6640 on Thursday. Technical analysis of the daily chart suggests a short-term bearish outlook as the pair remains below the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) is below 50, reinforcing the bearish sentiment.Regarding support, the AUD/USD pair could retest its two-month low of 0.6614, last seen on Wednesday. The next key support appears at the psychological level of 0.6600.On the upside, resistance is expected at the nine-day EMA at 0.6680, followed by the 50-day EMA at 0.6728. A break above these levels could open the door for a potential move toward the psychological resistance of 0.6800.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

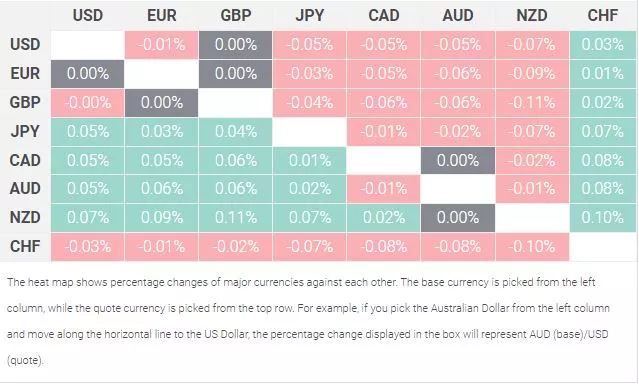

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc. More By This Author:

More By This Author: