The AUD/USD weekly forecast is slightly bullish as the likelihood of another rate hike by the RBA has increased after the rise in Australian CPI.–Are you interested in learning more about copy trading platforms? Check our detailed guide-Ups and downs of AUD/USDAUD/USD closed the week higher as the dollar weakened. Despite the release of mostly upbeat consumer confidence and employment data, the dollar faced headwinds as it lost its safe-haven appeal. Fortunately, the US avoided a debt default, allowing risk appetite to return to the markets.By approving a bill on Thursday night to suspend the debt ceiling, the US Senate eliminated a crucial factor supporting the dollar. Surprisingly, the currency had benefited from the uncertainty due to its status as a safe-haven asset. On Thursday, the dollar experienced its largest decline in nearly a month. This drop followed indications from Fed officials that the central bank would not proceed with an interest rate hike in June. It, however, recovered slightly on Friday after the NFP report showed a still-tight US labor market.Next week’s key events for AUD/USD

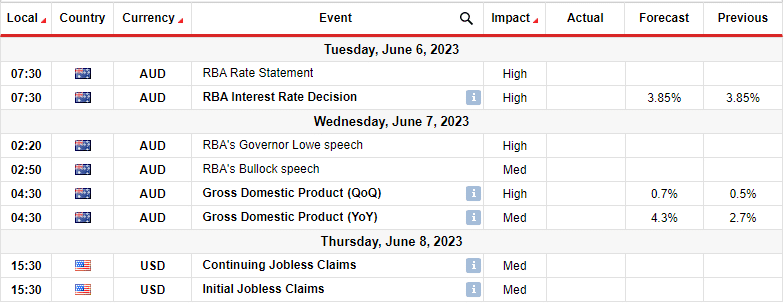

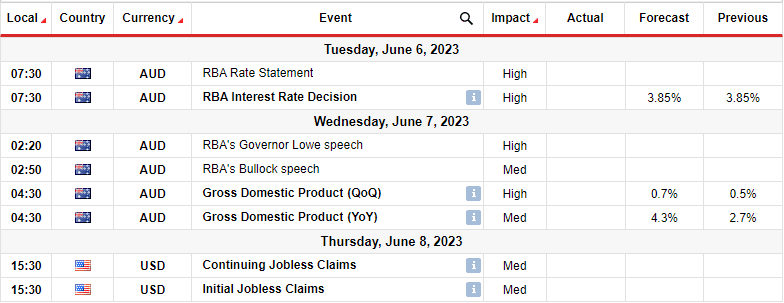

In the coming week, investors will focus on the RBA policy meeting, a speech from the RBA governor, and GDP data from Australia. The US will also release weekly employment data.Notably, recent data revealed a significant surge in consumer prices in April, surpassing expectations. This has led markets to anticipate a greater likelihood of another rate hike following a surprising policy rate increase to 3.85% earlier this month.AUD/USD weekly technical forecast: Buyers face pivotal resistance in the downtrend.

In the coming week, investors will focus on the RBA policy meeting, a speech from the RBA governor, and GDP data from Australia. The US will also release weekly employment data.Notably, recent data revealed a significant surge in consumer prices in April, surpassing expectations. This has led markets to anticipate a greater likelihood of another rate hike following a surprising policy rate increase to 3.85% earlier this month.AUD/USD weekly technical forecast: Buyers face pivotal resistance in the downtrend.

AUD/USD Weekly Forecast: RBA to Hike Rates Amid Hotter CPI