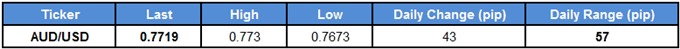

AUD/USD breaks out of a narrow range following the Federal Open Market Committee (FOMC) meeting, but the broader outlook remains tilted to the downside as the Reserve Bank of Australia (RBA) remains reluctant to lift the cash rate off of the record-low.

In light of the recent price action, AUD/USD looks poised for a larger recovery ahead of the next RBA meeting on November 7 as it initiates a fresh series of higher highs & lows. However, a 310K expansion in U.S. Non-Farm Payrolls (NFP) may temper the near-term rebound in the exchange rate as it encourages the FOMC to deliver a December rate-hike.

At the same time, a head-and-shoulders formation appears to be taking shape in AUD/USD following the break of the neckline around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion), and the pair may continue to give back the advance from the summer months should RBA Governor Philip Lowe and Co. continue to endorse a wait-and-see approach for monetary policy.

AUD/USD Daily Chart

- Near-term outlook for AUD/USD has shifted to the upside as the pair comes off of channel support and carves a bullish sequence, with the 0.7650 (38.2% retracement) region offering support; the Relative Strength Index (RSI) appears to be highlighting a similar dynamic as it rebounds ahead of oversold territory.

- A close back above the Fibonacci overlap around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion) raises the risk for a move back towards 0.7850 (38.2% retracement) to 0.7860 (61.8% retracement), which lines up with channel resistance.

- Keep in mind, the broader outlook remains tilted the downside as a head-and-shoulders formation unfolds, with the next downside target coming in around 0.7590 (100% expansion) followed by the overlap around 0.7460 (23.6% retracement) to 0.7530 (38.2% expansion).

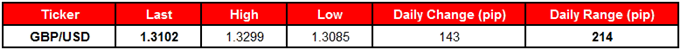

GBP/USD gives back the advance from earlier this week even as the Bank of England (BoE) raises the benchmark interest rate for the first time since 2006, and the pound-dollar exchange rate may continue to consolidate over the near-term as the central bank appears to be in no rush to further normalize monetary policy.