- Risk-On Mode seems in the market

- USD trading lower at the moment

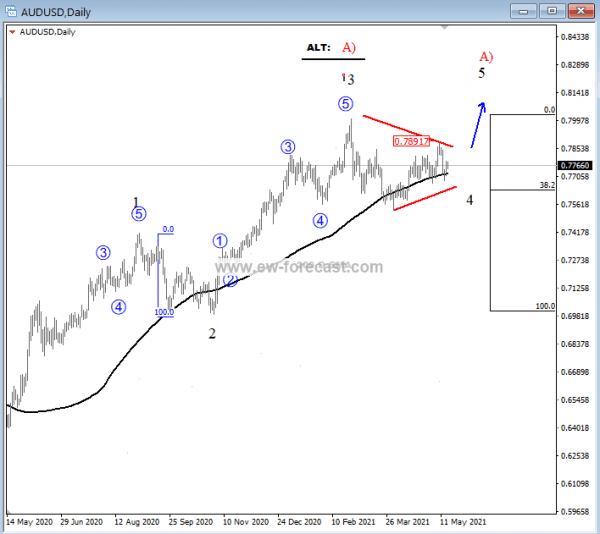

- Aussie is trading into triangle and eyes for higher move

FED members are not ready to change their policy despite the recent rise in inflation, so risk-on is visible through the charts with stocks moving higher while dollar is trading lower across the board. OIL is also at the highs, as well as metals.

What is rally important is strong AUDUSD which is up despite a decision that RBA will keep rates on hold until 2024 so it’s clear and important evidence how weak the USD is at the moment.

From an Elliott Wave perspective, we see Aussie still in the middle of a big triangle that can send prices higher in June, once the A-B-C-D-E triangle is completed in wave four. Pair is also supported by 200 daily SMA.

AUDUSD Daily Elliott Wave Analysis Chart