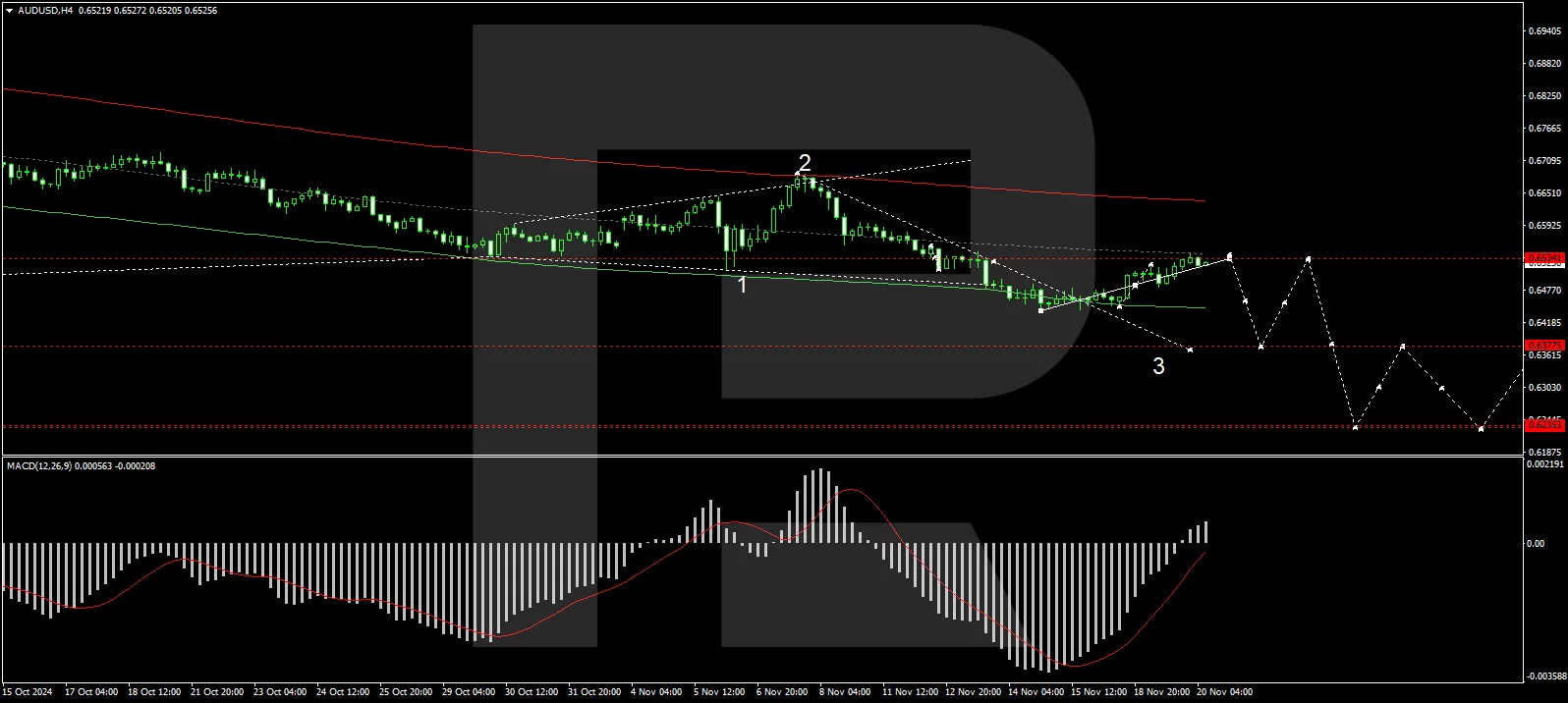

The Australian dollar against the US dollar is currently experiencing a pause in its recent upward trajectory, stabilizing around 0.6525 on the H4 chart. After three sessions of gains, the currency pair is undergoing a period of consolidation, likely preparing for a return to a stable ascending trend.The slight retreat in the US dollar, driven by profit-taking after its rally and anticipation of new developments in the US Treasury under President Donald Trump, has influenced the performance of the AUD.The minutes from the Reserve Bank of Australia’s latest meeting highlight the bank’s commitment to maintaining a restrictive monetary policy until inflation consistently approaches the target range. The RBA remains open to adjusting its policy stance in response to changing economic conditions, with market expectations leaning towards a potential rate cut in the coming months, with a 37% probability in February and 58% in April.Technical analysis of AUD/USD(Click on image to enlarge) H4 chart: The AUD/USD pair is currently in a phase of correction following a downturn that saw the local decline target at 0.6440 reached. The market is forming a corrective wave towards 0.6543. If this correction is completed, a new downtrend towards 0.6380 is anticipated. The MACD indicator supports this bearish , positioned below the zero line and poised to descend to new lows.(Click on image to enlarge)

H4 chart: The AUD/USD pair is currently in a phase of correction following a downturn that saw the local decline target at 0.6440 reached. The market is forming a corrective wave towards 0.6543. If this correction is completed, a new downtrend towards 0.6380 is anticipated. The MACD indicator supports this bearish , positioned below the zero line and poised to descend to new lows.(Click on image to enlarge) H1 chart: On the H1 chart, AUD/USD is approaching the correction target near 0.6543, forming a consolidation pattern just below this level. The breakout from this consolidation is expected to be downwards, initiating another phase of decline. The immediate target for this decline is set at 0.6464. The Stochastic oscillator reinforces this bearish forecast, with its signal line pointing downwards towards the 20 mark, indicating potential further declines.More By This Author:

H1 chart: On the H1 chart, AUD/USD is approaching the correction target near 0.6543, forming a consolidation pattern just below this level. The breakout from this consolidation is expected to be downwards, initiating another phase of decline. The immediate target for this decline is set at 0.6464. The Stochastic oscillator reinforces this bearish forecast, with its signal line pointing downwards towards the 20 mark, indicating potential further declines.More By This Author:

AUD/USD Consolidates After Recent Gains