The overwhelming pressure from China is just too much. Despite a solid jobs market at home, the Australian dollar is sliding.

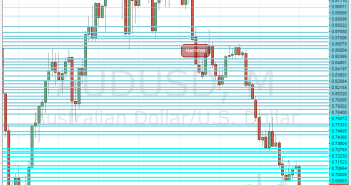

The pair lost the 0.69 level and is now trading at the lowest levels since 2009.

Australia’s job report beat expectations for a third month in a row, defied skeptics that worried about the quality of the data released by the authorities. The trend is clear: the Australian economy is not extremely dependent on China and can walk on its own legs.

But for the Australian dollar and not the Australian economy, it’s all about China: the fresh fall in the Chinese stock market at the close of the week, the fears about the bust of a credit bubble and also a general fall in commodities, including yet another fall of oil prices under $30, all take their toll.

More bad news came from the shutdown of the Bald Hill mine – this company was unable to sell bauxite because of Chinese stockpiles. Production has been halted after no buyers were found for this material, bauxite.

In this risk off environment, AUD/USD is seen as expensive and the only way is down.

Aussie/USD has reached a low of 0.6881 0.6970 at the time of writing, the lowest since March 2009. This is basically uncharted territory and we could see some kind of support at the round number of 0.68.

Resistance is at 0.69, followed by 0.6940 and 0.70. The Aussie has shown resilience in the past and it’s unclear if the only way is down.

In any case, here is the chart: