All the gains that Japan’s Nikkei 225 futures had achieved in the post-FOMC-Minutes exuberance have been lost as first Japan (huge miss in machine orders) and then China (huge miss in imports and exports) hit the market with a disappointing data double whammy. US futures are relatively untouched for now (even as USDJPY tumbles back below 102). Asian equity markets are mixed (China/India down notably and Japan fading fast) as another Chinese bank has “delayed payment” on a bond. Copper prices have also reverted and given up post-FOMC gains (despite rumors of PBOC bailout buying).

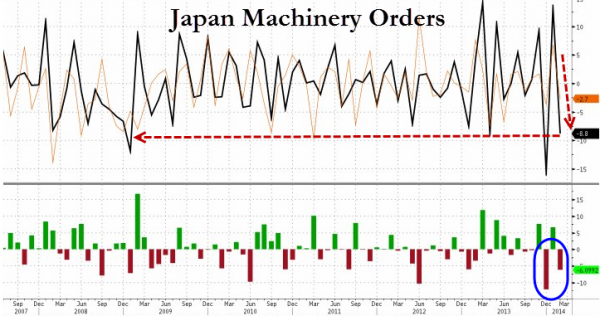

First, Japan machine orders (a primary macro data item) missed by a mile…

Then Beijing SAFE Bank “delayed payment on a bond…

China Beijing Safe Bank Investment Funds has delayed a payment to investors on a Shandong province expressway project, 21st Century Business Herald reports, citing a notice hung on the door of the co.

A person answering the phone at the co. who wouldn’t give her name declined to comment

The co.’s president has left his position, the report says

Co. is seeking to sell new products through a private equity platform to make the payment, the report cites an unidentified person from the co. as saying

BJ Unsafe

And then Chinese trade data hit and was total fucking shitshow – no exaggeration…

- *CHINA’S MARCH IMPORTS FALL 11.3% FROM YEAR EARLIER

- *CHINA’S MARCH EXPORTS FALL 6.6% FROM YEAR EARLIER

But don’t worry because the customs chaps think…

- CHINA IMPORTS, EXPORTS TO RESUME Y/Y GROWTH FROM MAY: CUSTOMS

But it seems to us that there is a long way for “exports” to adjust to real non-fake trade invoice data…

Which left the Nikkei having entirely roundtripped its post FOMC gains and reverted to USDJPY…

And copper prices given up all their post FOMC gains…

Charts: Bloomberg