Image Source:

Image Source:

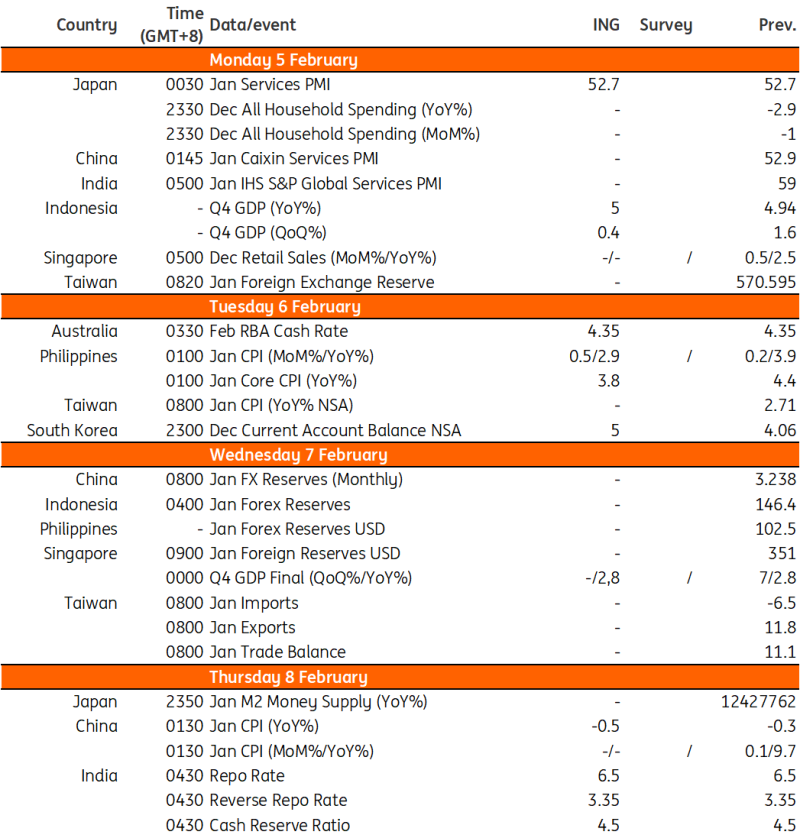

Both the RBI and RBA meet next week to decide on policy, and both are expected to pause. China Caixin PMI will also be released alongside Indonesia’s GDP and regional inflation numbers.

RBA likely to keep setting untouchedThe Reserve Bank of Australia (RBA) meets on 6 February to consider monetary policy, and there is virtually no prospect of any change. Cash rate futures are now pricing in a more than 50% chance of easing by May, helped by recent inflation data. However, we think that the inflation picture is less impressive than it appears, and is largely base effect-driven, while monthly run rates remain high.We expect inflation to start heading higher over January and February, which may lead to some pullback – much like we have seen in the US. The RBA may use the opportunity to push back a bit at market pricing, which could speed this adjustment along.

RBI also set to holdWe also have the first Reserve Bank of India (RBI) meeting of the year on 8 February. Inflation is back up at the higher end of the RBI’s target (5.69% vs target of 4+/-2%) as food prices have risen again. This removes any incentive the RBI has for acting unilaterally to ease policy, rather than waiting for the US Fed to move before beginning to ease – as we suspect will be the case for most regional central banks, including the RBI.

Key data reports from ChinaWe will see the January Caixin services and composite PMIs to start the week, where if it follows the CFLP data, a small uptick can be expected. January foreign reserves data will be published on Thursday, where we will likely see a smaller fluctuation after two consecutive months of relatively large increases.CPI and PPI inflation data will also be published on Friday. CPI inflation is expected to remain in negative territory for perhaps the final month, impacted by the Lunar New Year effect. High frequency data indicates that food prices edged down in sequential terms but at a slower pace than the two previous months.It is possible that the aggregate financing, loans and money supply data will be released as early as Friday, when we expect a spike in lending activity to start the year.

Inflation in Taiwan is expected to trend lowerTaiwan’s January CPI inflation and trade data will be released on Tuesday and Wednesday respectively. Taiwan’s CPI has fluctuated in a relatively stable range of around 2-3% over the past year and is expected to trend down slightly in 2024.January’s trade data will be watched closely to gauge the impact of a sharper-than-expected drop in export orders last month.

Indonesia GDP likely to settle at 5%We expect fourth quarter GDP to settle at 5.0% year-on-year, supported by a healthy dose of household spending given improving retail sales figures reported in the last few months of 2023. Inflation remained subdued and at the lower end of the central bank’s target, which likely fostered a good run of spending. We expect GDP to accelerate in the first quarter, however, as election-related spending helps bolster overall economic activity.

Philippine inflation to slowJanuary inflation is set for release next week. We expect inflation to settle at 2.9% YoY, within the inflation target of the Bangko Sentral ng Pilipinas (BSP) and also within its inflation forecast of 2.8% to 3.6% YoY. Favorable base effects and slower inflation for key agricultural products should help lower headline inflation. BSP Governor Eli Remolona will be monitoring price developments, although he did indicate that his preference is to keep rates higher for longer.

Key events in Asia next week Image Source: Refinitiv, INGMore By This Author:Key Events In Developed Markets And EMEA – Week Of Monday, February 5French Industrial Output Continues Its Rebound FX Daily: US Employment Continues On A Benign Trend?

Image Source: Refinitiv, INGMore By This Author:Key Events In Developed Markets And EMEA – Week Of Monday, February 5French Industrial Output Continues Its Rebound FX Daily: US Employment Continues On A Benign Trend?

Asia Week Ahead: RBA And RBI Decide On Policy While Regional Players Report Inflation