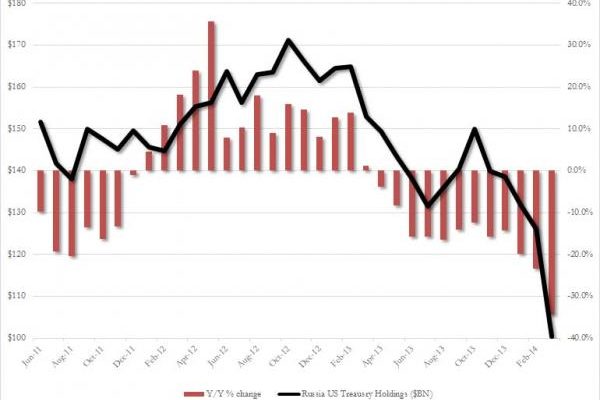

Last week we commented that based on TIC data, while “Belgium’s” unprecedented Treasury buying spree continues, one country has been dumping US bonds at an unprecedented rate, and in March alone Russia sold a record $26 billion, or 20% of its holdings.

So as Russia is selling record amount of US paper, what is it buying? For the answer we go to Goldcore which tells us that…

Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April

The Russian central bank has again increased its gold reserves by another 900,000 ounces worth $1.17 billion in April.

Russia’s gold reserves rose to 34.4 million troy ounces in April, from 33.5 million troy ounces in March, the Russian central bank announced on its website yesterday. The value of its gold holdings rose to $44.30 billion as of May 1, compared with $43.36 billion a month earlier, it added.

The following is a summary from Bloomberg of the April data template on international reserves and foreign currency liquidity from the Central Bank of Russia in Moscow:

Russia’s gold & foreign exchange reserves remained virtually unchanged at USD 471.1billion in the week ending May 9. Russia’s reserves have fallen since the crisis began but remain very sizeable. The reserves include monetary gold, special drawing rights, reserve position at the IMF and foreign exchange.

The 900,000 ounce purchase is a lot of physical gold in ounce or tonnage terms but as a percentage of Russian foreign exchange reserves it is a very small 0.24%.

Gold as a percentage of the overall Russian reserves is now nearly 10%. This remains well below the average gold holding as a percentage of foreign exchange reserves of major central banks such as the Bundesbank, Bank of France and the Federal Reserve which is over 65%.

The Russian central bank has been gradually increasing the Russian reserves since 2006 (see chart above). On average they have been accumulating 0.5 million troy ounces every month. Therefore, the near 1 million ounce purchase in April is a definite increase in demand.